Van segment rates still not showing seasonal strength

Broker-posted spot rates in the Truckstop system declined for the fourth straight week during the week ended November 11 (week 45) as dry van and refrigerated continued to lag seasonal expectations with Thanksgiving and Black Friday approaching. Dry van rates eased after a tiny gain in the prior week. Refrigerated rates were up for the second straight week, but neither week’s increase was robust. Rate changes for the current week will be especially telling regarding the van segments’ strength.

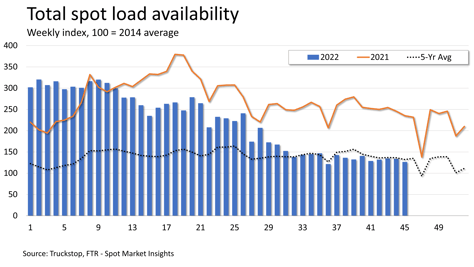

Spot load activity decreased 5.6% after easing 0.5% in the previous week. Volume was about 46% below the same 2021 week and more than 4% below the five-year average. As was the case in the prior week, the West Coast continued to lead volume gains, and Mountain Central was the only other region to post an increase week over week. Truck availability increased 1.9%. The Market Demand Index – the ratio of loads to trucks – fell to just slightly above the level four weeks earlier.

Spot load activity decreased 5.6% after easing 0.5% in the previous week. Volume was about 46% below the same 2021 week and more than 4% below the five-year average. As was the case in the prior week, the West Coast continued to lead volume gains, and Mountain Central was the only other region to post an increase week over week. Truck availability increased 1.9%. The Market Demand Index – the ratio of loads to trucks – fell to just slightly above the level four weeks earlier.

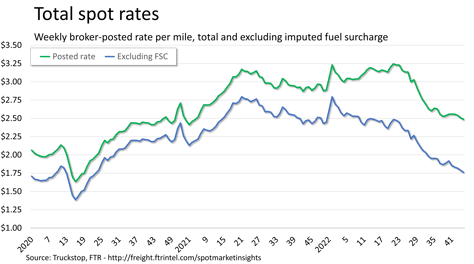

The total broker-posted rate fell just over 2 cents. Rates were almost 14% below the same 2021 week but nearly 9% above the five-year average for the week. However, FTR estimates that rates excluding a calculated fuel surcharge were more than 27% below the same week last year.

The total broker-posted rate fell just over 2 cents. Rates were almost 14% below the same 2021 week but nearly 9% above the five-year average for the week. However, FTR estimates that rates excluding a calculated fuel surcharge were more than 27% below the same week last year.

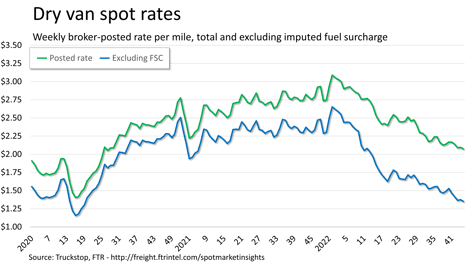

Dry van spot rates declined just over 2 cents. Rates were nearly 25% below the same 2021 week and more than 4% below the five-year average for the week. FTR estimates that dry van rates excluding a fuel surcharge were more than 41% lower than in the same week last year. Dry van loads fell 5.5%. Volume was up in the West Coast and Mountain Central regions but down elsewhere. Dry van volume was nearly 45% below the same 2021 week and 4% below the five-year average for the week.

Dry van spot rates declined just over 2 cents. Rates were nearly 25% below the same 2021 week and more than 4% below the five-year average for the week. FTR estimates that dry van rates excluding a fuel surcharge were more than 41% lower than in the same week last year. Dry van loads fell 5.5%. Volume was up in the West Coast and Mountain Central regions but down elsewhere. Dry van volume was nearly 45% below the same 2021 week and 4% below the five-year average for the week.

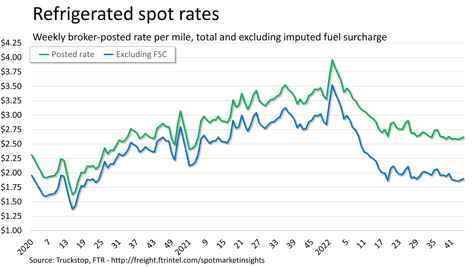

Refrigerated spot rates increased just under 3 cents. Rates were about 22% below the same 2021 week but nearly 4% above the five-year average for the week. However, rates excluding fuel surcharges were almost 35% below the same week last year. Refrigerated loads jumped 13%, which is the segment’s largest increase since the week following Labor Day. Volume was up in all regions except the Northeast. Refrigerated volume was nearly 48% below the same week last year but less than 1% below the five-year average.

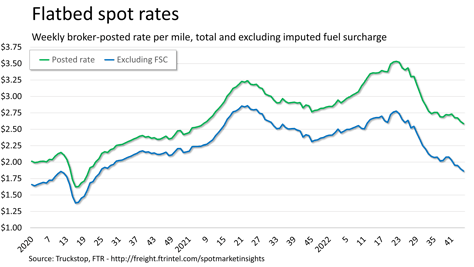

Flatbed spot rates fell more than 3 cents. Rates were nearly 7% below the same 2021 week but nearly 16% above the five-year average for the week. However, excluding an imputed surcharge, flatbed rates were more than 20% below the same week last year. Flatbed loads fell 14.9%, which is the largest drop since Labor Day week. Load activity was down in all regions. Flatbed volume was about 55% below the same 2021 week and nearly 20% below the five-year average for the week.