Flatbed was a drag on the spot market in the latest week

Broker-posted spot rates in the Truckstop system for dry van and refrigerated were hardly robust, but they were up during the week ended November 4 (week 44) while flatbed rates fell. Van segment rate gains lagged the typical pre-Thanksgiving strength that begins in early November, and dry van weakness was especially pronounced. Van segment volume remains close to five-year average levels. Flatbed volume is fairly stable at below average levels. The West Coast continued to lead total volume gains.

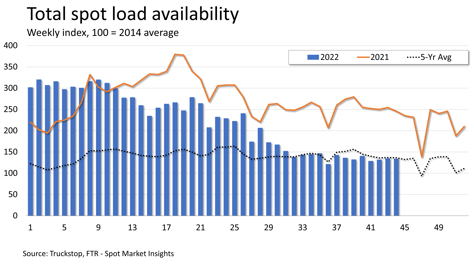

Spot load activity dipped 0.5% after a 2.0% gain in the previous week. Volume was nearly 46% below the same 2021 week and nearly 2% below the five-year average. As was the case in the prior week, the West Coast led all regions in volume gains as the largest regions saw either no growth or declines. Truck availability dropped 6.6%, which was the largest decrease since Labor Day week. The Market Demand Index – the ratio of loads to trucks – rose to its highest level in four weeks.

Spot load activity dipped 0.5% after a 2.0% gain in the previous week. Volume was nearly 46% below the same 2021 week and nearly 2% below the five-year average. As was the case in the prior week, the West Coast led all regions in volume gains as the largest regions saw either no growth or declines. Truck availability dropped 6.6%, which was the largest decrease since Labor Day week. The Market Demand Index – the ratio of loads to trucks – rose to its highest level in four weeks.

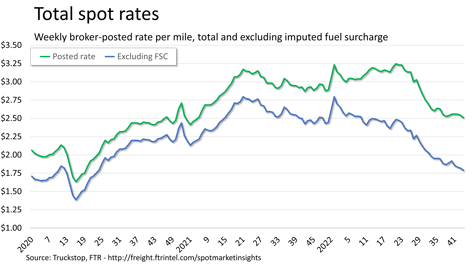

The total broker-posted rate fell just over 3 cents due mostly to the fairly sharp drop in flatbed rates. Rates were more than 14% below the same 2021 week but about 9% above the five-year average for the week. However, FTR estimates that rates excluding a calculated fuel surcharge were almost 28% below the same week last year.

The total broker-posted rate fell just over 3 cents due mostly to the fairly sharp drop in flatbed rates. Rates were more than 14% below the same 2021 week but about 9% above the five-year average for the week. However, FTR estimates that rates excluding a calculated fuel surcharge were almost 28% below the same week last year.

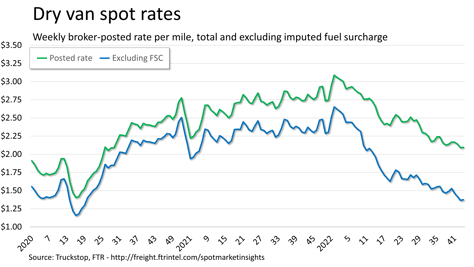

Dry van spot rates ticked up just over half a cent. Rates were nearly 25% below the same 2021 week and about 2% below the five-year average for the week. FTR estimates that dry van rates excluding a fuel surcharge were nearly 41% lower than in the same week last year. Dry van loads edged up 0.7%. Volume decreases in the Northeast and Midwest offset most of the gains seen elsewhere. Dry van volume was about 43% below the same 2021 week but 0.4% above the five-year average for the week.

Dry van spot rates ticked up just over half a cent. Rates were nearly 25% below the same 2021 week and about 2% below the five-year average for the week. FTR estimates that dry van rates excluding a fuel surcharge were nearly 41% lower than in the same week last year. Dry van loads edged up 0.7%. Volume decreases in the Northeast and Midwest offset most of the gains seen elsewhere. Dry van volume was about 43% below the same 2021 week but 0.4% above the five-year average for the week.

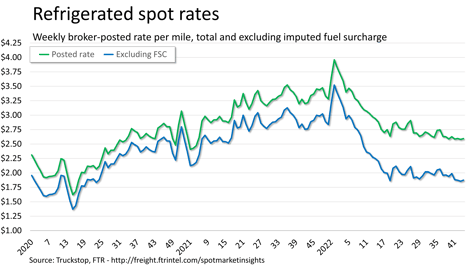

Refrigerated spot rates increased 1.4 cents. Rates were about 22% below the same 2021 week but nearly 4% above the five-year average for the week. However, rates excluding fuel surcharges were about 35% below the same week last year. Refrigerated loads rose 6.6%. Volume was up in all regions except the Northeast and was led by the Mountain Central and West Coast regions. Refrigerated volume was nearly 55% below the same week last year and nearly 7% below the five-year average.

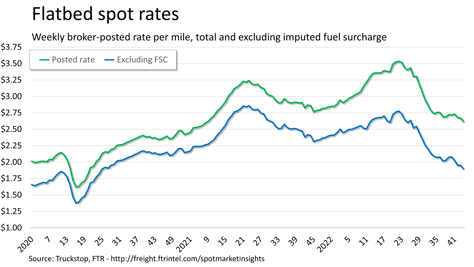

Flatbed spot rates fell 5.4 cents. Rates were more than 8% below the same 2021 week but about 15% above the five-year average for the week. Excluding an imputed surcharge, flatbed rates were 21% below the same week last year. Flatbed loads decreased 3.1%. Load activity was up sharply once again on the West Coast but was down sharply in the Northeast, South Central, and Southeast regions. Flatbed volume was about 51% below the same 2021 week and nearly 13% below the five-year average for the week.