Spot rates change little as volume ticks higher in the latest week

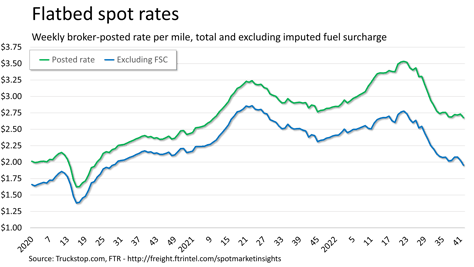

Although broker-posted spot rates were down in all segments except refrigerated during the week ended October 21 (week 42), owing to the mix of freight, total spot rates declined only a fraction of a cent. Flatbed rates saw the largest decline, but they are still higher than the van segments, and flatbed volume rose while the others saw lower load postings. The van segments continue to track closely to five-year average levels in both rates and volume while flatbed rates are still above average.

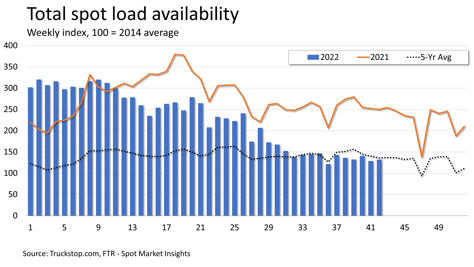

Spot load activity increased 2.5% after dropping 8.4% in the previous week. Volume was about 47% below the same 2021 week and 3% below the five-year average. Truck availability increased 4.2%, and the Market Demand Index – the ratio of loads to trucks – fell to its lowest level since May 2020.

Spot load activity increased 2.5% after dropping 8.4% in the previous week. Volume was about 47% below the same 2021 week and 3% below the five-year average. Truck availability increased 4.2%, and the Market Demand Index – the ratio of loads to trucks – fell to its lowest level since May 2020.

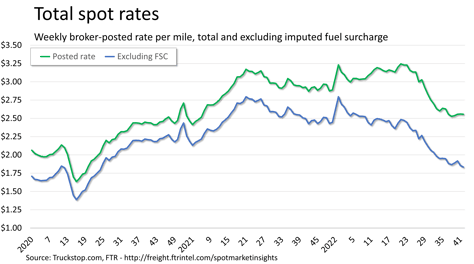

The total broker-posted rate eased three-tenths of a cent. Rates were nearly 11% below the same 2021 week but nearly 12% above the five-year average for the week. However, FTR estimates that rates excluding a calculated fuel surcharge were more than 24% lower than during the same week last year.

The total broker-posted rate eased three-tenths of a cent. Rates were nearly 11% below the same 2021 week but nearly 12% above the five-year average for the week. However, FTR estimates that rates excluding a calculated fuel surcharge were more than 24% lower than during the same week last year.

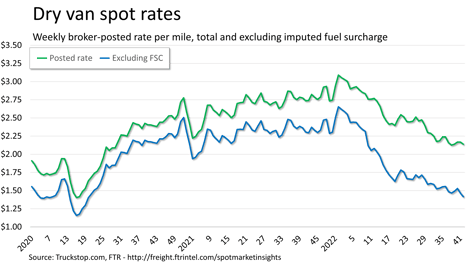

Dry van spot rates declined 3 cents after holding basically flat in the prior week. Rates were 22% lower than the same 2021 week but more than 1% above the five-year average for the week. FTR estimates that dry van rates excluding a fuel surcharge were more than 38% lower than in the same week last year. Dry van loads eased 1%. Volume was nearly 48% below the same 2021 week but almost 1% above the five-year average for the week.

Dry van spot rates declined 3 cents after holding basically flat in the prior week. Rates were 22% lower than the same 2021 week but more than 1% above the five-year average for the week. FTR estimates that dry van rates excluding a fuel surcharge were more than 38% lower than in the same week last year. Dry van loads eased 1%. Volume was nearly 48% below the same 2021 week but almost 1% above the five-year average for the week.

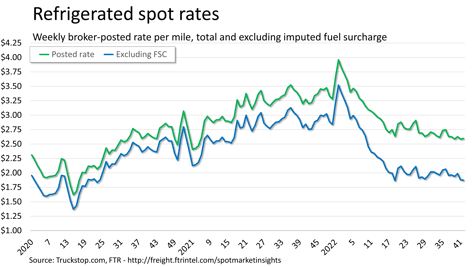

Refrigerated spot rates increased just over 1 cent after falling just over 4 cents in the previous week. Rates were about 19% below the same 2021 week but about 7% above the five-year average for the week. Rates excluding fuel surcharges were 32% below the same week last year. Refrigerated loads fell 6.2%. Volume was almost 53% below the same week last year but half a percent above the five-year average.

Flatbed spot rates fell 5.5 cents after increasing more than 1 cent in the prior week. Rates were more than 5% below the same 2021 week but nearly 17% above the five-year average for the week. However, excluding an imputed surcharge, flatbed rates were 18% below the same week last year. Flatbed loads rose 8.5%. Volume was about 52% below the same 2021 week and nearly 17% below the five-year average for the week.