Spot metrics mostly move seasonally in the latest week

Total spot rates in the Truckstop.com system barely changed and spot loads fell during the week ended October 14 (week 41), mostly matching seasonal expectations. With dry van rates nearly flat, a small gain in flatbed rates largely offset a decline in refrigerated rates. However, a sharp jump in diesel prices during the week resulted in a notable drop in rates net of fuel costs. The West Coast saw its weakest spot volume since May 2020 and loads in the Southeast fell sharply after recent strength.

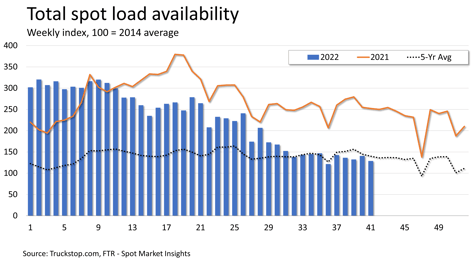

Total load postings fell 8.4% after a 6.1% gain in the prior week. Volume was down nearly 49% compared to the same 2021 week and was 8% below the five-year average. Total load postings were down in all regions except for the Northeast and Mountain Central regions. Loads fell about 18% in the Southeast, and West Coast volume fell 8.5% to its lowest level since May 2020, likely reflecting a sharp decline in West Coast imports. Truck postings increased 3.7%, which is the largest gain since August aside from the rebound from Labor Day week. The Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since May 2020.

Total load postings fell 8.4% after a 6.1% gain in the prior week. Volume was down nearly 49% compared to the same 2021 week and was 8% below the five-year average. Total load postings were down in all regions except for the Northeast and Mountain Central regions. Loads fell about 18% in the Southeast, and West Coast volume fell 8.5% to its lowest level since May 2020, likely reflecting a sharp decline in West Coast imports. Truck postings increased 3.7%, which is the largest gain since August aside from the rebound from Labor Day week. The Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since May 2020.

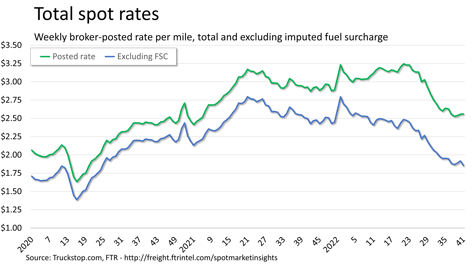

The total broker-posted rate in the system was basically unchanged, rising three-tenths of a cent. Rates were almost 13% below the same 2021 week but nearly 11% above the five-year average for the week. However, FTR estimates that excluding an imputed fuel surcharge, rates were nearly 26% below the same week last year. Rates net of fuel costs fell in the latest week, which saw a jump in diesel prices of more than 38 cents a gallon on average nationwide. The weekly gain in diesel prices was the third largest on record, surpassed only by those in each of the first two weeks of March.

The total broker-posted rate in the system was basically unchanged, rising three-tenths of a cent. Rates were almost 13% below the same 2021 week but nearly 11% above the five-year average for the week. However, FTR estimates that excluding an imputed fuel surcharge, rates were nearly 26% below the same week last year. Rates net of fuel costs fell in the latest week, which saw a jump in diesel prices of more than 38 cents a gallon on average nationwide. The weekly gain in diesel prices was the third largest on record, surpassed only by those in each of the first two weeks of March.

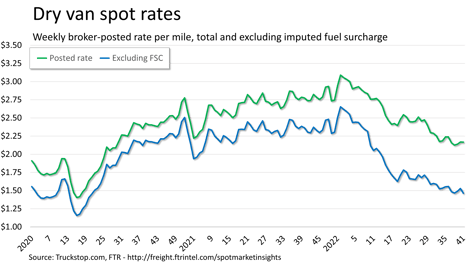

Dry van spot rates were essentially flat, dipping just two-tenths of a cent. Rates were about 21% lower than the same 2021 week but 2% above the five-year average for the week. Excluding an imputed fuel surcharge, rates were almost 37% below the prior-year level. Dry van load postings decreased 5.6%. Volume was down more than 21% in the Southeast and fell significantly on the West Coast, where load volume was the weakest since late December 2020. Dry van volume was about 46% below the level posted in the same 2021 week but just barely above the five-year average for the week.

Dry van spot rates were essentially flat, dipping just two-tenths of a cent. Rates were about 21% lower than the same 2021 week but 2% above the five-year average for the week. Excluding an imputed fuel surcharge, rates were almost 37% below the prior-year level. Dry van load postings decreased 5.6%. Volume was down more than 21% in the Southeast and fell significantly on the West Coast, where load volume was the weakest since late December 2020. Dry van volume was about 46% below the level posted in the same 2021 week but just barely above the five-year average for the week.

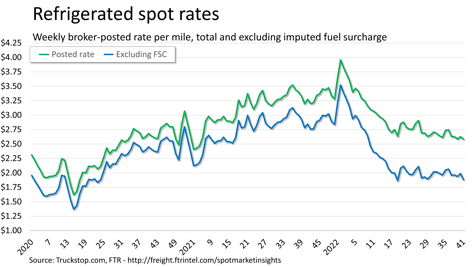

Refrigerated spot rates decreased about 4 cents, essentially reversing the prior week’s gain. Rates were about 21% below the same 2021 week but more than 5% above the five-year average for the week. Rates excluding fuel surcharges were about 34% below the same week last year. Refrigerated load postings declined 5.4%. The segment’s sharpest volume drop was more than 23% in the Southeast, but loads also were down in the South Central and Midwest regions. Volume was almost 50% below the same 2021 week but nearly 6% above the five-year average for the week.

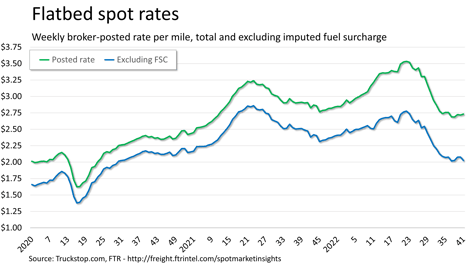

Flatbed spot rates increased more than 1 cent. Rates were 6% below the same 2021 week but about 18% above the five-year average for the week. However, excluding an imputed surcharge, flatbed rates were about 18% below the same week last year. Flatbed load postings fell 13.3% after a gain of almost exactly the same magnitude in the previous week. Volume was down sharply in all regions except for the Northeast. West Coast load postings, which fell more than 22%, were at their lowest level since May 2020. Volume was about 58% below the same 2021 week and about 26% below the five-year average for the week.