Spot rates hold steady, volume falls in holiday week

The spot market continued to move in a typical seasonal fashion during the week ended September 9 (week 36) as total rates in the Truckstop.com system barely changed but volume dropped sharply due to the Labor Day holiday. Dry van and flatbed rates were essentially flat as refrigerated rates edged up just over 1 cent. The coming week could be interesting due to the potential for a rail strike. Even if a strike ultimately is averted, shippers might send more freight to trucks as a precaution.

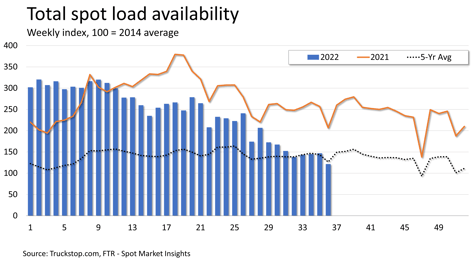

Total load postings fell 17.2%, which is similar to declines typically seen during Labor Day holiday weeks. Volume was about 41% below the same 2021 week and nearly 4% below the five-year average for the week. Load postings were down in all regions. Truck postings fell 14.5%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – eased to its lowest level since week 33.

Total load postings fell 17.2%, which is similar to declines typically seen during Labor Day holiday weeks. Volume was about 41% below the same 2021 week and nearly 4% below the five-year average for the week. Load postings were down in all regions. Truck postings fell 14.5%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – eased to its lowest level since week 33.

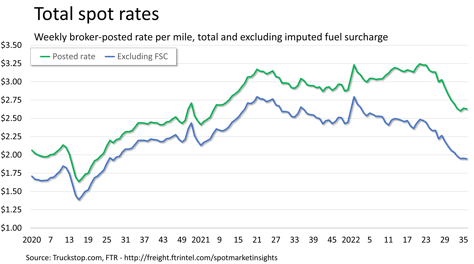

The total broker-posted rate in the system eased 1 cent. The broker-posted rate was nearly 13% below the same 2021 week but nearly 11% above the five-year average. However, FTR estimates that excluding an imputed fuel surcharge, rates were nearly 26% below the same week last year.

The total broker-posted rate in the system eased 1 cent. The broker-posted rate was nearly 13% below the same 2021 week but nearly 11% above the five-year average. However, FTR estimates that excluding an imputed fuel surcharge, rates were nearly 26% below the same week last year.

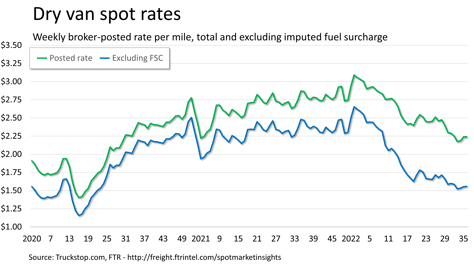

Dry van spot rates declined by two-tenths of a cent after two weeks of increases. Rates were nearly 22% lower than the same 2021 week but 0.6% higher than the five-year average for the week. However, dry van rates were about 37% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings fell nearly 12%. Volume was about 42% below the level posted in the same 2021 week and about 3% below the five-year average for the week.

Dry van spot rates declined by two-tenths of a cent after two weeks of increases. Rates were nearly 22% lower than the same 2021 week but 0.6% higher than the five-year average for the week. However, dry van rates were about 37% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings fell nearly 12%. Volume was about 42% below the level posted in the same 2021 week and about 3% below the five-year average for the week.

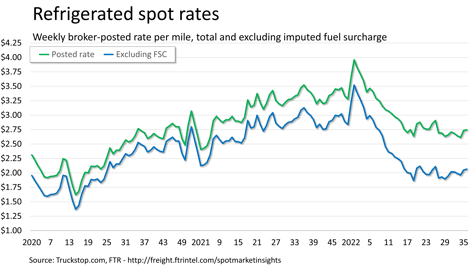

Refrigerated spot rates increased 1.2 cents after rising about 12 cents in the prior week. Rates were about 22% below the same 2021 week but more than 4% above the five-year average for the week. Rates excluding fuel surcharges were 34% below the same week last year. Refrigerated load postings fell 11.6%. Volume was about 38% below the same 2021 week but nearly 12% above the five-year average for the week.

Refrigerated spot rates increased 1.2 cents after rising about 12 cents in the prior week. Rates were about 22% below the same 2021 week but more than 4% above the five-year average for the week. Rates excluding fuel surcharges were 34% below the same week last year. Refrigerated load postings fell 11.6%. Volume was about 38% below the same 2021 week but nearly 12% above the five-year average for the week.

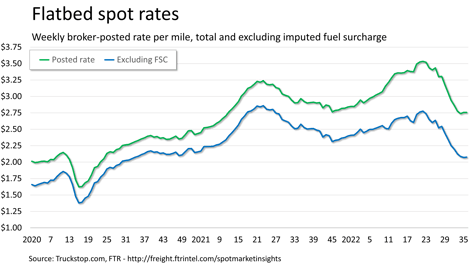

Flatbed spot rates eased by a tenth of a cent. Rates were 5.7% below the same 2021 week, but they were still nearly 18% above the five-year average for the week. Excluding an imputed surcharge, flatbed rates were about 18% below the same week last year. Flatbed load postings fell 23.3%. Volume was about 48% below the same 2021 week and about 18% below the five-year average for the week.