Total spot rates rise for the first time since mid-July

The spot market largely moved according to seasonal expectations during the week ended September 2 (week 35) as total rates in the Truckstop.com system rose for the first time since mid-July. Dry van saw its largest rate gain since June, and refrigerated rates rose by the most since May. The week heading into Labor Day typically is the strongest for van segment rates between late June and Thanksgiving. Flatbed rates moved higher for the first time in seven weeks. Total spot volume edged higher.

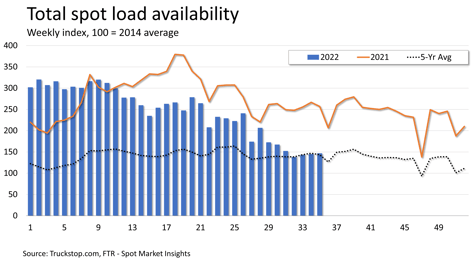

Total load postings increased 1.4%, which is slightly stronger than the previous week. Volume was nearly 43% below the same 2021 week but 2.4% above the five-year average for the week after lagging the average for three straight weeks. Load postings were down in the Southeast and West Coast regions but higher in all other regions. Truck postings eased 0.7%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – edged higher.

Total load postings increased 1.4%, which is slightly stronger than the previous week. Volume was nearly 43% below the same 2021 week but 2.4% above the five-year average for the week after lagging the average for three straight weeks. Load postings were down in the Southeast and West Coast regions but higher in all other regions. Truck postings eased 0.7%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – edged higher.

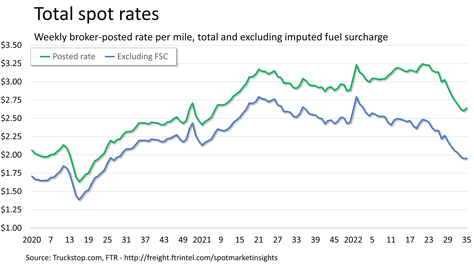

The total broker-posted rate in the system increased nearly 4 cents for the first week-over-week gain since mid-July and only the second increase since week 21. However, with a large increase in diesel prices during the week, FTR estimates that rates excluding an imputed fuel surcharge barely moved. The broker-posted rate was more than 13% below the same 2021 week but nearly 11% above the five-year average. Excluding fuel surcharges, rates were more than 26% below the same week last year.

The total broker-posted rate in the system increased nearly 4 cents for the first week-over-week gain since mid-July and only the second increase since week 21. However, with a large increase in diesel prices during the week, FTR estimates that rates excluding an imputed fuel surcharge barely moved. The broker-posted rate was more than 13% below the same 2021 week but nearly 11% above the five-year average. Excluding fuel surcharges, rates were more than 26% below the same week last year.

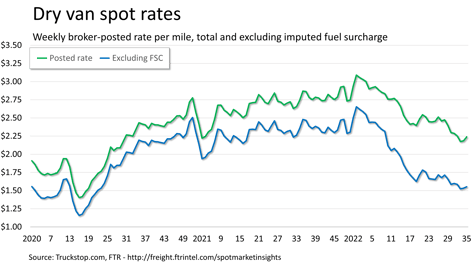

Dry van spot rates increased more than 5 cents for the second straight weekly gain. Rates were 22% lower than the same 2021 week but 0.5% higher than the five-year average for the week. However, dry van rates were more than 37% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings barely moved, edging up just 0.3%. Volume was about 48% below the level posted in the same 2021 week and about 5% below the five-year average for the week.

Dry van spot rates increased more than 5 cents for the second straight weekly gain. Rates were 22% lower than the same 2021 week but 0.5% higher than the five-year average for the week. However, dry van rates were more than 37% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings barely moved, edging up just 0.3%. Volume was about 48% below the level posted in the same 2021 week and about 5% below the five-year average for the week.

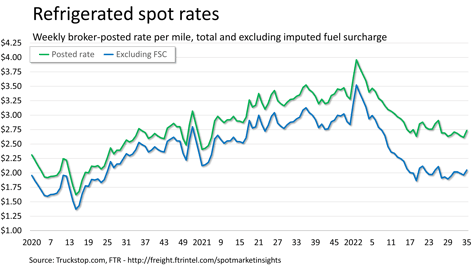

Refrigerated spot rates jumped nearly 12 cents, which is the largest increase since week 20. Rates were about 21% below the same 2021 week but nearly 4% above the five-year average for the week. Rates excluding fuel surcharges were nearly 34% below the same week last year. Refrigerated load postings increased 2.5%. Volume was about 51% below the same 2021 week but nearly 3% above the five-year average for the week.

Refrigerated spot rates jumped nearly 12 cents, which is the largest increase since week 20. Rates were about 21% below the same 2021 week but nearly 4% above the five-year average for the week. Rates excluding fuel surcharges were nearly 34% below the same week last year. Refrigerated load postings increased 2.5%. Volume was about 51% below the same 2021 week but nearly 3% above the five-year average for the week.

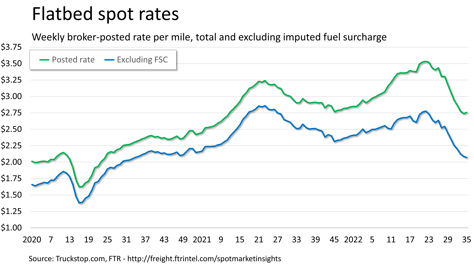

Flatbed spot rates ticked up 2 cents for the first increase in seven weeks. Rates were 7% below the same 2021 week, but they were still nearly 18% above the five-year average for the week. Excluding an imputed surcharge, flatbed rates were nearly 20% below the same week last year. Flatbed load postings increased 1.2%. Volume was nearly 42% below the same 2021 week and about 1% below the five-year average for the week.