Spot rates and volume were mixed in the latest week

The total broker-posted rate in the Truckstop.com system declined modestly during the week ended August 26 (week 34), although the dry van segment posted a slight increase. Spot rates in the refrigerated and flatbed segments fell, but the decreases were smaller than in the previous week. Total spot load postings were only slightly stronger week over week as a decrease in flatbed volume offset gains in the van segments. The ratio of loads to trucks moved higher for the first time since early June.

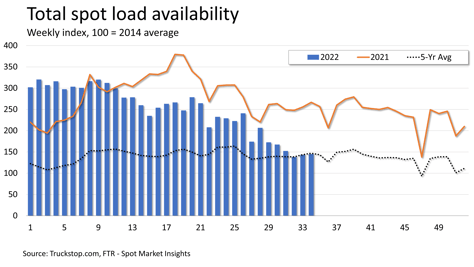

Total load postings increased 1.0%. Volume was nearly 46% below the same 2021 week and 1.4% below the five-year average for the week. Load postings were mixed by region, but volume was down in the three largest regions by volume – the Midwest, Southeast, and South Central. However, load postings on the West Coast jumped nearly 19%. Truck postings eased 1.4%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – edged higher for the first week-over-week increase since week 24 of the year.

Total load postings increased 1.0%. Volume was nearly 46% below the same 2021 week and 1.4% below the five-year average for the week. Load postings were mixed by region, but volume was down in the three largest regions by volume – the Midwest, Southeast, and South Central. However, load postings on the West Coast jumped nearly 19%. Truck postings eased 1.4%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – edged higher for the first week-over-week increase since week 24 of the year.

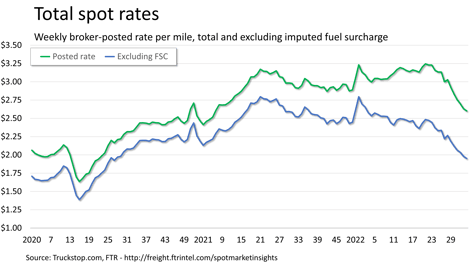

The total broker-posted rate in the system fell about 3 cents for the 12th decrease in 13 weeks. Rates were nearly 12% below the same 2021 week, but they were nearly 11% above the five-year average for the week. FTR estimates that excluding an imputed fuel surcharge, rates would be down about 24% year over year. Spot rates during the current week (week 35) traditionally are stronger week over week heading into the Labor Day holiday.

The total broker-posted rate in the system fell about 3 cents for the 12th decrease in 13 weeks. Rates were nearly 12% below the same 2021 week, but they were nearly 11% above the five-year average for the week. FTR estimates that excluding an imputed fuel surcharge, rates would be down about 24% year over year. Spot rates during the current week (week 35) traditionally are stronger week over week heading into the Labor Day holiday.

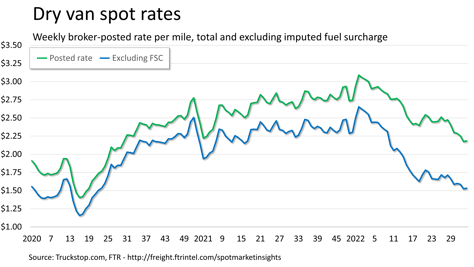

Dry van spot rates ticked up 1 cent after five straight weeks of declines. Rates were about 20% lower than the same 2021 week but about 1% higher than the five-year average for the week. However, dry van rates were about 35% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings increased 3.6%. Volume was about 49% below the level posted in the same 2021 week and about 5% below the five-year average for the week.

Dry van spot rates ticked up 1 cent after five straight weeks of declines. Rates were about 20% lower than the same 2021 week but about 1% higher than the five-year average for the week. However, dry van rates were about 35% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings increased 3.6%. Volume was about 49% below the level posted in the same 2021 week and about 5% below the five-year average for the week.

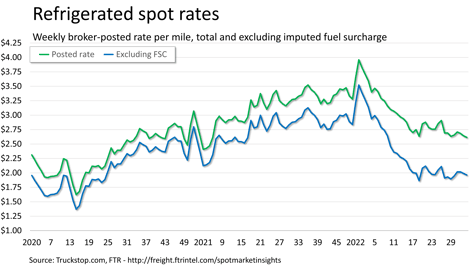

Refrigerated spot rates declined 2.6 cents. Rates were 22% below the same 2021 week but more than 1% above the five-year average for the week. Rates excluding fuel surcharges were nearly 34% below the same week last year. Refrigerated load postings jumped 11.4% for the strongest gain since week 25. Volume was about 51% below the same 2021 week but nearly 2% above the five-year average for the week.

Refrigerated spot rates declined 2.6 cents. Rates were 22% below the same 2021 week but more than 1% above the five-year average for the week. Rates excluding fuel surcharges were nearly 34% below the same week last year. Refrigerated load postings jumped 11.4% for the strongest gain since week 25. Volume was about 51% below the same 2021 week but nearly 2% above the five-year average for the week.

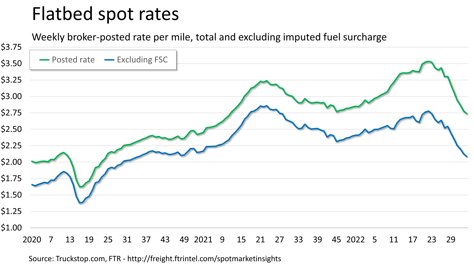

Flatbed spot rates fell about 4 cents, which is the smallest decrease since a tiny increase in week 28. Rates were nearly 6% below the same 2021 week, but they were still more than 17% above the five-year average for the week. Excluding an imputed surcharge, flatbed rates were about 17% below the same week last year. Flatbed load postings fell 3.7%. Volume was more than 47% below the same 2021 week and about 8% below the five-year average for the week.