Spot rates and volume fall in all segments in the latest week

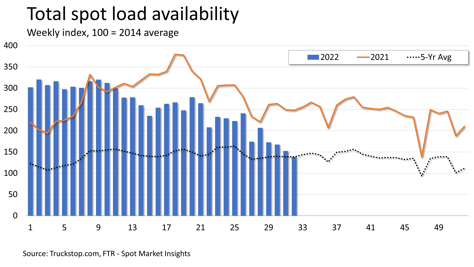

Spot metrics in the Truckstop.com system were uniformly weaker during the week ended August 12 (week 32) as flatbed spot rates continued to fall more sharply than rates in dry van and refrigerated. The decline in flatbed rates was not as steep as it had been in each of the three preceding weeks, but it was still quite large for the segment. Total load postings fell for the fourth straight week and were below the comparable five-year average level for the first time since late June 2020.

Total load postings decreased 9.4%, which is slightly steeper than the decline in the prior week. Volume was about 44% below the same 2021 week and 0.4% below the five-year average for the week. Load postings were down in all regions, although the decline on the West Coast was just 0.4%. Truck postings increased nearly 3%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since early June 2020.

Total load postings decreased 9.4%, which is slightly steeper than the decline in the prior week. Volume was about 44% below the same 2021 week and 0.4% below the five-year average for the week. Load postings were down in all regions, although the decline on the West Coast was just 0.4%. Truck postings increased nearly 3%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since early June 2020.

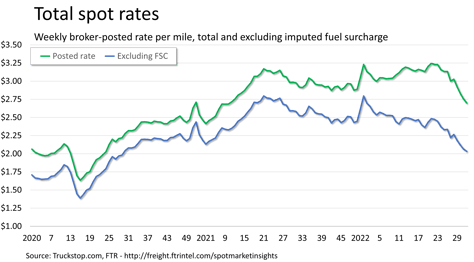

The total broker-posted rate in the system fell more than 5 cents. Rates in the system were 7.5% below the same 2021 week – the same as the week 31 comparison – but they were nearly 16% above the five-year average for the week. However, FTR estimates that excluding an imputed fuel surcharge, rates would be down nearly 20% year over year.

The total broker-posted rate in the system fell more than 5 cents. Rates in the system were 7.5% below the same 2021 week – the same as the week 31 comparison – but they were nearly 16% above the five-year average for the week. However, FTR estimates that excluding an imputed fuel surcharge, rates would be down nearly 20% year over year.

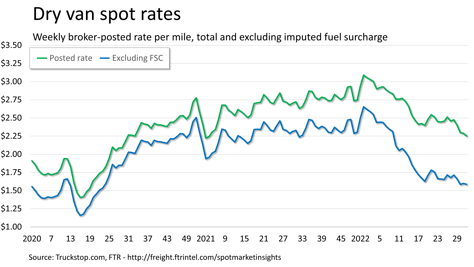

Dry van spot rates decreased nearly 4 cents. Rates were more than 14% lower than the same 2021 week but about 6% higher than the five-year average for the week. However, dry van rates were about 29% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings fell 11.6%, which was the sharpest decline of all segments. Volume was about 46% below the level posted in the same 2021 week and just barely (0.3%) above the five-year average for the week.

Dry van spot rates decreased nearly 4 cents. Rates were more than 14% lower than the same 2021 week but about 6% higher than the five-year average for the week. However, dry van rates were about 29% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings fell 11.6%, which was the sharpest decline of all segments. Volume was about 46% below the level posted in the same 2021 week and just barely (0.3%) above the five-year average for the week.

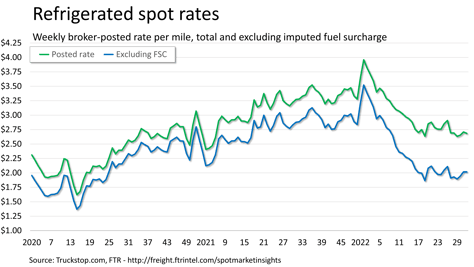

Refrigerated spot rates eased 2.5 cents. Rates were about 18% below the same 2021 week but nearly 8% above the five-year average for the week. However, rates excluding fuel surcharges were about 30% below the same week last year. Refrigerated load postings declined 4.8%. Volume was nearly 50% below the same week last year but about 4% above the five-year average for the week.

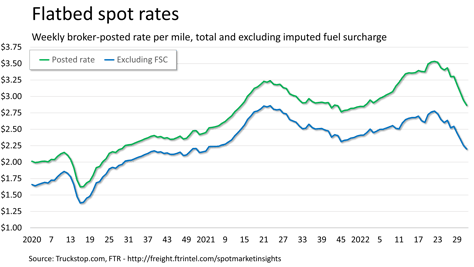

Flatbed spot rates fell nearly 8 cents, which is smaller than recent decreases but still a large drop for the segment by historical standards. Rates were nearly 3% below the same 2021 week, but they were still about 22% above the five-year average for the week. However, excluding an imputed surcharge, flatbed rates were nearly 14% below the same week last year. Flatbed load postings fell 9.2%. Volume was about 47% below the same 2021 week and nearly 9% below the five-year average for the week.