Flatbed and dry van rates fall sharply

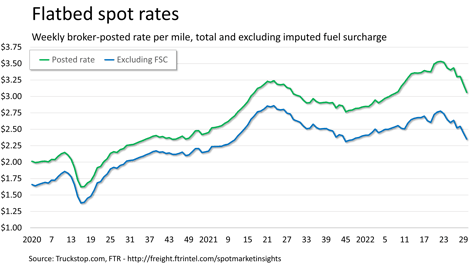

Total spot rates in the Truckstop.com system fell sharply during the week ended July 29 (week 30), although the refrigerated segment eked out a small gain. Broker-posted flatbed rates continued to plunge, and dry van rates saw their largest drop since mid-April. Flatbed rates have fallen more than 37 cents over the past four weeks, and the three decreases during that period are among the five largest on record. Flatbed rates appear to be normalizing as volume is far below comparable 2021 levels.

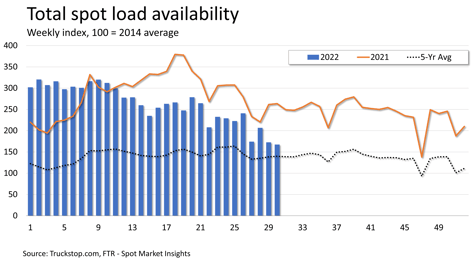

Total load postings declined 2.9% after dropping 16.6% during the previous week. Volume was nearly 37% below the same 2021 week but nearly 20% above the five-year average for the week. Load postings were up in several regions but fell in the three regions with the most volume – Southeast, Midwest, and South Central. Truck postings eased 0.6%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since June 2020.

Total load postings declined 2.9% after dropping 16.6% during the previous week. Volume was nearly 37% below the same 2021 week but nearly 20% above the five-year average for the week. Load postings were up in several regions but fell in the three regions with the most volume – Southeast, Midwest, and South Central. Truck postings eased 0.6%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since June 2020.

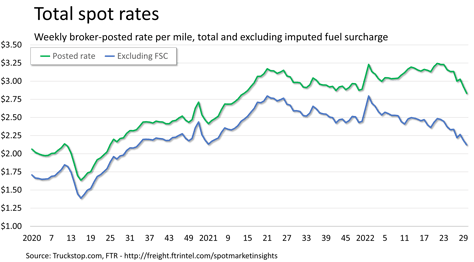

The total broker-posted rate in the system fell more than 9 cents. Rates in the system were about 5% below the same 2021 week but more than 20% above the five-year average for the week. However, FTR estimates that excluding an imputed fuel surcharge, rates would be down about 18% year over year.

The total broker-posted rate in the system fell more than 9 cents. Rates in the system were about 5% below the same 2021 week but more than 20% above the five-year average for the week. However, FTR estimates that excluding an imputed fuel surcharge, rates would be down about 18% year over year.

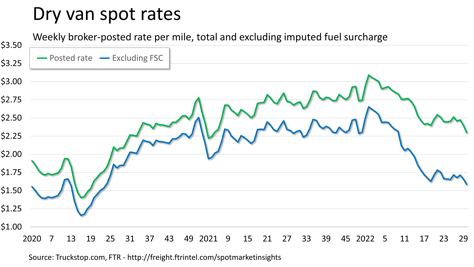

Dry van spot rates fell just over 10 cents. Rates were about 15% lower than the same 2021 week but nearly 9% higher than the five-year average for the week. However, dry van rates were nearly 32% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings declined 0.9%. Volume was nearly 37% below the level posted in the same 2021 week but more than 21% above the five-year average.

Dry van spot rates fell just over 10 cents. Rates were about 15% lower than the same 2021 week but nearly 9% higher than the five-year average for the week. However, dry van rates were nearly 32% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings declined 0.9%. Volume was nearly 37% below the level posted in the same 2021 week but more than 21% above the five-year average.

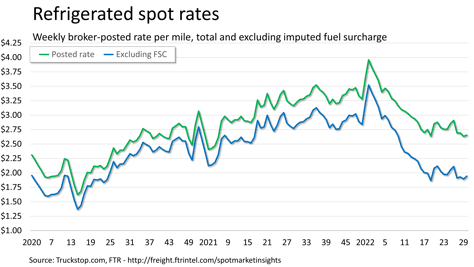

Refrigerated spot rates increased more than 2 cents. Rates were nearly 18% below the same 2021 week but more than 8% above the five-year average for the week. However, rates excluding fuel surcharges were more than 31% below the same week last year. Refrigerated load postings ticked up 0.9%. Volume was more than 40% below the same week last year but about 23% above the five-year average.

Flatbed spot rates dropped nearly 12 cents, which was less than 1 cent less than the decrease in the prior week. Rates are a little more than 1% above the same 2021 week, but they are nearly 29% above the five-year average for the week. However, excluding an imputed surcharge, flatbed rates were nearly 11% below the same week last year. Flatbed load postings fell 5.6% after dropping nearly 20% during the previous week. Volume was nearly 41% below the same 2021 week but nearly 11% above the five-year average for the week.

Flatbed spot rates dropped nearly 12 cents, which was less than 1 cent less than the decrease in the prior week. Rates are a little more than 1% above the same 2021 week, but they are nearly 29% above the five-year average for the week. However, excluding an imputed surcharge, flatbed rates were nearly 11% below the same week last year. Flatbed load postings fell 5.6% after dropping nearly 20% during the previous week. Volume was nearly 41% below the same 2021 week but nearly 11% above the five-year average for the week.