Spot volume rebounds from the holiday while rates change little

Load postings in the Truckstop.com system rose sharply during the week ended July 15 (week 28) as big gains in flatbed and dry van following the July 4th holiday week offset a modest decline in refrigerated volume. Spot rates in individual segments changed little during the week although the total market rate increased primarily due to the freight mix. The spot market historically would not see much upward pressure in the coming weeks, but lingering supply chain issues could disrupt seasonality.

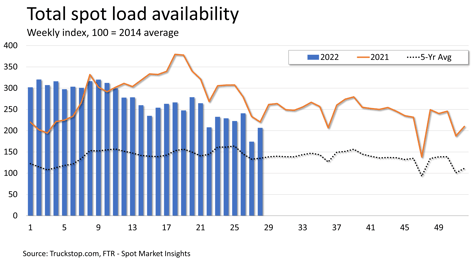

Total load postings rose 19.8% following the 27.4% drop during the July 4th holiday week. Volume, which rose in all regions, was about 6% below the same 2021 week but about 53% above the five-year average for the week. The increase in truck postings slightly exceeded the gain in volume, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – eased to its lowest level since November 2020.

Total load postings rose 19.8% following the 27.4% drop during the July 4th holiday week. Volume, which rose in all regions, was about 6% below the same 2021 week but about 53% above the five-year average for the week. The increase in truck postings slightly exceeded the gain in volume, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – eased to its lowest level since November 2020.

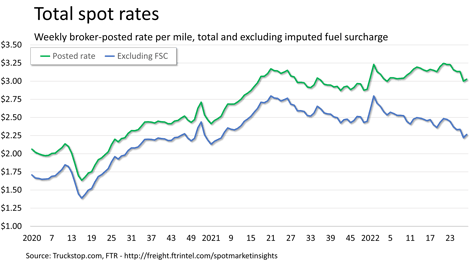

Although no segment saw a gain that large, the total broker-posted rate in the system increased nearly 3 cents. As has often been the case recently, the market rate outpaced individual segments because of the mix of freight. Flatbed saw the largest volume gain, and its current spot rate is nearly 62 cents ahead of refrigerated and about 83 cents ahead of dry van. Total spot rates in the system were 1.0% below the same 2021 week but about 27% above the five-year average for the week. FTR estimates that excluding an imputed fuel surcharge, rates would be down about 15% year over year but about 12% ahead of the five-year average.

Although no segment saw a gain that large, the total broker-posted rate in the system increased nearly 3 cents. As has often been the case recently, the market rate outpaced individual segments because of the mix of freight. Flatbed saw the largest volume gain, and its current spot rate is nearly 62 cents ahead of refrigerated and about 83 cents ahead of dry van. Total spot rates in the system were 1.0% below the same 2021 week but about 27% above the five-year average for the week. FTR estimates that excluding an imputed fuel surcharge, rates would be down about 15% year over year but about 12% ahead of the five-year average.

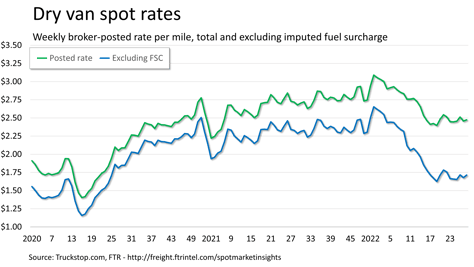

Dry van spot rates increased nearly 2 cents. Dry van rates were 9% lower than the same 2021 week but about 16% higher than the five-year average for the week. However, rates were more than 28% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings rose 19.8% and were higher in all regions. Dry van volume was 3% above the level posted in the same 2021 week and about 61% above the five-year average.

Dry van spot rates increased nearly 2 cents. Dry van rates were 9% lower than the same 2021 week but about 16% higher than the five-year average for the week. However, rates were more than 28% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings rose 19.8% and were higher in all regions. Dry van volume was 3% above the level posted in the same 2021 week and about 61% above the five-year average.

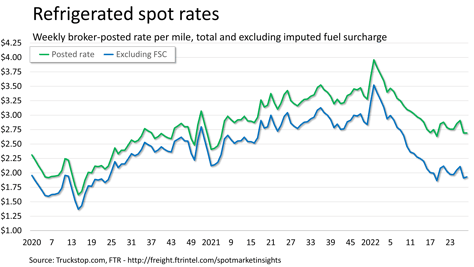

Refrigerated spot rates were essentially flat week over week after plunging nearly 22 cents in the holiday week. Rates were nearly 16% below the same 2021 week but more than 9% above the five-year average for the week. However, rates excluding fuel surcharges were about 31% below the same week last year. Refrigerated load postings decreased 7% as volume was mixed by region. Volume was about 14% below the same week last year but about 53% above the five-year average.

Refrigerated spot rates were essentially flat week over week after plunging nearly 22 cents in the holiday week. Rates were nearly 16% below the same 2021 week but more than 9% above the five-year average for the week. However, rates excluding fuel surcharges were about 31% below the same week last year. Refrigerated load postings decreased 7% as volume was mixed by region. Volume was about 14% below the same week last year but about 53% above the five-year average.

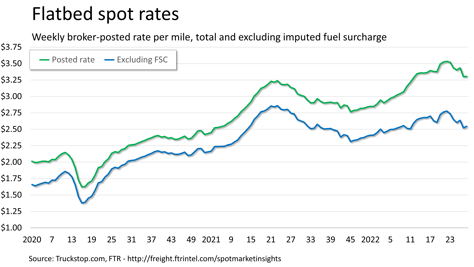

Flatbed spot rates increased less than 1 cent after dropping more than 13 cents during the previous week. Rates were about 6% above those in the same 2021 week and nearly 37% above the five-year average for the week. Excluding an imputed surcharge, flatbed rates were nearly 7% below the same week last year. Flatbed load postings, which rose in all regions, jumped more than 24% after falling more than 28% during the holiday week. Volume was about 14% below the same 2021 week but about 44% above the five-year average for the week.

Flatbed spot rates increased less than 1 cent after dropping more than 13 cents during the previous week. Rates were about 6% above those in the same 2021 week and nearly 37% above the five-year average for the week. Excluding an imputed surcharge, flatbed rates were nearly 7% below the same week last year. Flatbed load postings, which rose in all regions, jumped more than 24% after falling more than 28% during the holiday week. Volume was about 14% below the same 2021 week but about 44% above the five-year average for the week.