Spot rates plunge during the July 4th holiday week

Total spot rates in the Truckstop.com system saw one of their largest drops ever during the week ended July 8 (week 27). The decline in dry van rates was not unusually large, but the decreases in flatbed and refrigerated rates were among the largest ever in each segment. Big drops in spot volume are typical for the week that includes the July 4th holiday, but declines in spot rates tend not to be so large. Volume was right on trend, however, as load postings fell nearly sharply in all segments.

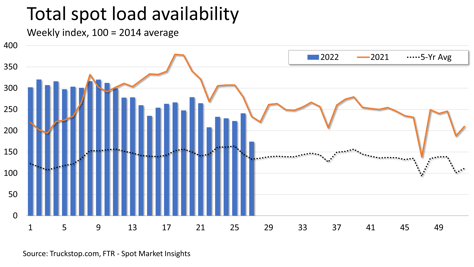

Total load postings fell 27.6%, which is weaker than the performance in 2020 and 2021 but otherwise a typical decrease for the July 4th holiday week. A seasonal move in volume is a further indication that the spot market is normalizing. Volume was more than 25% below the same 2021 week but about 31% above the five-year average for the week. Load postings were lower week over week in all regions. Truck postings fell by almost exactly the same degree as loads, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – barely changed.

Total load postings fell 27.6%, which is weaker than the performance in 2020 and 2021 but otherwise a typical decrease for the July 4th holiday week. A seasonal move in volume is a further indication that the spot market is normalizing. Volume was more than 25% below the same 2021 week but about 31% above the five-year average for the week. Load postings were lower week over week in all regions. Truck postings fell by almost exactly the same degree as loads, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – barely changed.

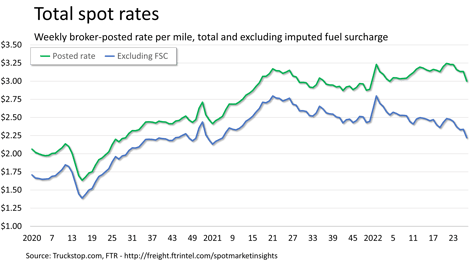

Total broker-posted rates in the system fell more than 13 cents, which is the largest decrease since the beginning of 2021 and otherwise the largest on record aside for two weeks in April 2020. Total spot rates in the system were 2.3% below the same 2021 week for the largest negative year-over-year comparison in exactly two years. FTR estimates that excluding an imputed fuel surcharge rates would be down more than 17% year over year. Compared to the five-year average, the broker-posted rate is still nearly 25% higher.

Total broker-posted rates in the system fell more than 13 cents, which is the largest decrease since the beginning of 2021 and otherwise the largest on record aside for two weeks in April 2020. Total spot rates in the system were 2.3% below the same 2021 week for the largest negative year-over-year comparison in exactly two years. FTR estimates that excluding an imputed fuel surcharge rates would be down more than 17% year over year. Compared to the five-year average, the broker-posted rate is still nearly 25% higher.

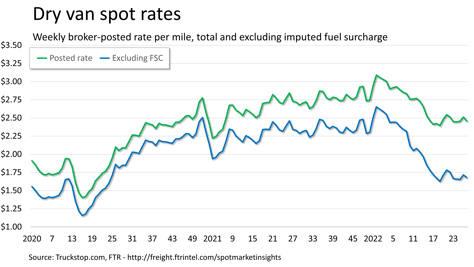

Dry van spot rates declined nearly 6 cents for a fairly typical decline during the holiday week. Dry van rates were 10% lower than the same 2021 week but more than 28% lower if an imputed fuel surcharge is excluded. Dry van load postings fell 27.6%, and all regions saw declines. Dry van volume was about 25% below the level posted in the same 2021 week but more than 28% above the five-year average for the week.

Dry van spot rates declined nearly 6 cents for a fairly typical decline during the holiday week. Dry van rates were 10% lower than the same 2021 week but more than 28% lower if an imputed fuel surcharge is excluded. Dry van load postings fell 27.6%, and all regions saw declines. Dry van volume was about 25% below the level posted in the same 2021 week but more than 28% above the five-year average for the week.

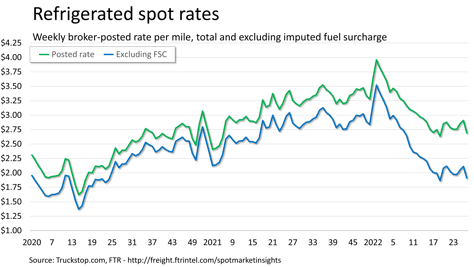

Refrigerated spot rates plunged nearly 22 cents, which is the largest drop since mid-January 2021 and one of the largest on record. Rates were about 17% below the same 2021 week but about 33% below that week excluding fuel surcharges. Refrigerated load postings fell 23% as a healthy increase in the Midwest region partially offset sharp declines elsewhere. Volume was about 24% below the same week last year but 50% above the five-year average for the week.

Refrigerated spot rates plunged nearly 22 cents, which is the largest drop since mid-January 2021 and one of the largest on record. Rates were about 17% below the same 2021 week but about 33% below that week excluding fuel surcharges. Refrigerated load postings fell 23% as a healthy increase in the Midwest region partially offset sharp declines elsewhere. Volume was about 24% below the same week last year but 50% above the five-year average for the week.

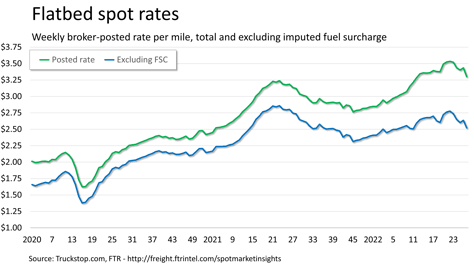

Flatbed spot rates fell more than 13 cents, which is the largest drop on record except for a week in April 2020 at the depths of the pandemic lockdowns. Rates were about 5% above those in the same 2021 week but about 8% lower excluding an imputed surcharge. Flatbed load postings fell 28.2% and were down in all regions. Volume was about 28% below the same 2021 week but about 25% above the five-year average for the week.

Flatbed spot rates fell more than 13 cents, which is the largest drop on record except for a week in April 2020 at the depths of the pandemic lockdowns. Rates were about 5% above those in the same 2021 week but about 8% lower excluding an imputed surcharge. Flatbed load postings fell 28.2% and were down in all regions. Volume was about 28% below the same 2021 week but about 25% above the five-year average for the week.