Spot rates rise in key segments during the latest week

As is typical for the week before the July 4th holiday, spot rates in the Truckstop.com system rose in the key segments of dry van, refrigerated, and flatbed during the week ended July 1 (week 26). However, the rate increases in the van segments were not especially robust relative to history. Dry van’s increase for week before the holiday was the smallest since 2019 while refrigerated’s gain was the smallest since 2015. However, flatbed’s increase was larger than typical for the week.

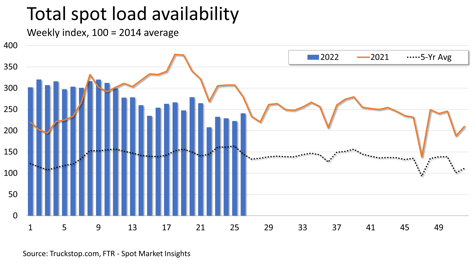

Total load postings rose 8.1%. Volume was about 14% below the same 2021 week but nearly 66% above the five-year average for the week. Load postings were higher week over week in all regions except for the South Central region. Truck postings jumped 19.8%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since November 2020.

Total load postings rose 8.1%. Volume was about 14% below the same 2021 week but nearly 66% above the five-year average for the week. Load postings were higher week over week in all regions except for the South Central region. Truck postings jumped 19.8%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since November 2020.

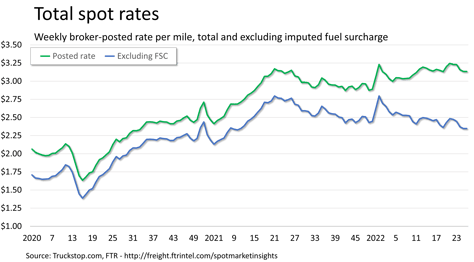

Total broker-posted rates in the system were essentially unchanged owing to the segment mix and a decrease in the specialized segment, which represents less than 10% of spot activity. Total spot rates in the system were 0.5% below the same 2021 week for the first negative year-over-year comparison since July 2020. FTR estimates that excluding an imputed fuel surcharge rates would be down around 15% year over year.

Total broker-posted rates in the system were essentially unchanged owing to the segment mix and a decrease in the specialized segment, which represents less than 10% of spot activity. Total spot rates in the system were 0.5% below the same 2021 week for the first negative year-over-year comparison since July 2020. FTR estimates that excluding an imputed fuel surcharge rates would be down around 15% year over year.

Note: The Energy Information Administration still has been unable to publish diesel prices due to system issues, so we continue to use the data for the week ended June 13 until updated data is available.

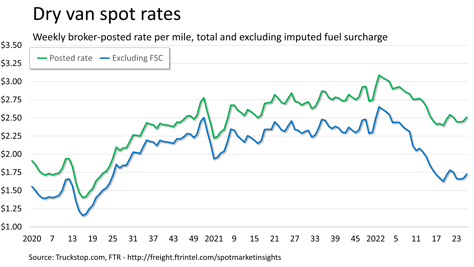

Dry van spot rates rose nearly 6 cents. The increase was just barely higher than the one in the week before the July 4th holiday in 2019 and otherwise the smallest for a comparable week since 2015. Dry van rates were nearly 12% lower than the same 2021 week. Dry van load postings jumped 20.8%, which is the largest increase since International Roadcheck week six weeks earlier. All regions saw gains of more than 20% except for the South Central region, where loads were up about 5%. Dry van volume was nearly 12% below the level posted in the same 2021 week but 63% above the five-year average for the week.

Dry van spot rates rose nearly 6 cents. The increase was just barely higher than the one in the week before the July 4th holiday in 2019 and otherwise the smallest for a comparable week since 2015. Dry van rates were nearly 12% lower than the same 2021 week. Dry van load postings jumped 20.8%, which is the largest increase since International Roadcheck week six weeks earlier. All regions saw gains of more than 20% except for the South Central region, where loads were up about 5%. Dry van volume was nearly 12% below the level posted in the same 2021 week but 63% above the five-year average for the week.

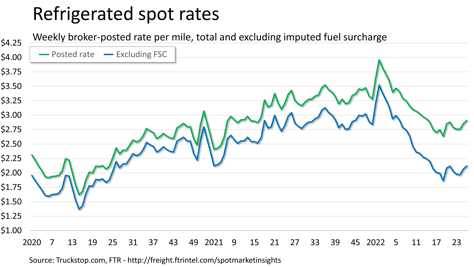

Refrigerated spot rates rose a bit more than 5 cents, which is the smallest gain for the week before the July 4th holiday since 2015. Rates were about 15% below the same 2021 week. Refrigerated load postings increased nearly 9%. Volume was up in all regions except the Mountain Central and South Central regions. Load postings were about 17% below the same week last year but more than 72% above the five-year average for the week.

Refrigerated spot rates rose a bit more than 5 cents, which is the smallest gain for the week before the July 4th holiday since 2015. Rates were about 15% below the same 2021 week. Refrigerated load postings increased nearly 9%. Volume was up in all regions except the Mountain Central and South Central regions. Load postings were about 17% below the same week last year but more than 72% above the five-year average for the week.

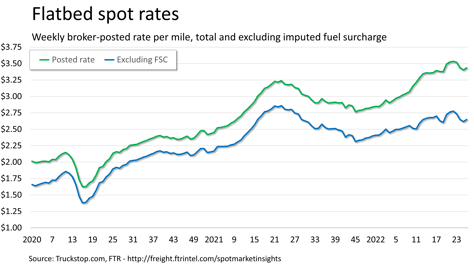

Flatbed spot increased about 3 cents, which is stronger than typical for the week before the July 4th holiday. Rates were nearly 8% above those in the same 2021 week. Flatbed load postings edged up just 0.8%, although the segment saw healthy gains in the Southeast and West Coast. Volume was about 18% below the same 2021 week but about 60% above the five-year average for the week.

Flatbed spot increased about 3 cents, which is stronger than typical for the week before the July 4th holiday. Rates were nearly 8% above those in the same 2021 week. Flatbed load postings edged up just 0.8%, although the segment saw healthy gains in the Southeast and West Coast. Volume was about 18% below the same 2021 week but about 60% above the five-year average for the week.