Flatbed rates fall sharply in the latest week

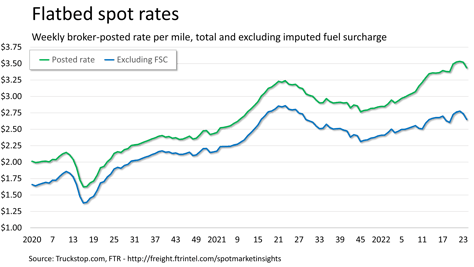

Van segment spot rates in the Truckstop.com system barely changed during the week ended June 17 (week 24), but flatbed spot rates saw their sharpest drop since mid-November. Flatbed’s recent rate strength – the segment posted a record two weeks earlier – appeared to run counter to other spot metrics, which had been cooling or stabilizing. The van segments have yet to show seasonal rate strength, but the largest gains typically occur in the back half of June. Total spot volume was down slightly.

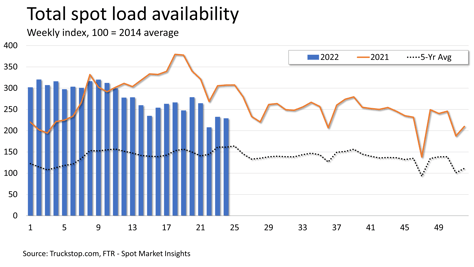

Total load postings declined 1.5%. Volume was about 25% below the same 2021 week but 42% above the five-year average for the week. The decreases in load availability were concentrated in the Southeast and Midwest. Truck postings decreased 4.4%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – edged higher.

Total load postings declined 1.5%. Volume was about 25% below the same 2021 week but 42% above the five-year average for the week. The decreases in load availability were concentrated in the Southeast and Midwest. Truck postings decreased 4.4%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – edged higher.

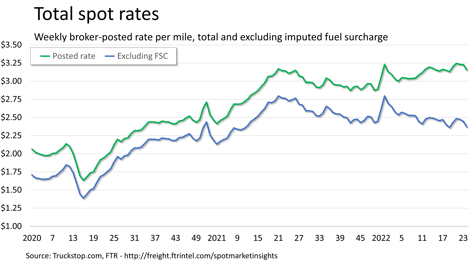

Total broker-posted rates decreased more than 7 cents. Total spot rates in the system were less than 2% ahead of the same 2021 week, but FTR estimates that excluding an imputed fuel surcharge rates would be down about 13% year over year. The broker-posted rate is about 8 cents below the record; the rate excluding fuel surcharges is about 42 cents below the record.

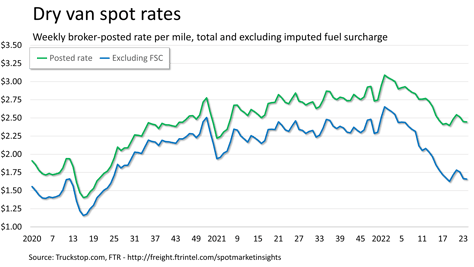

Dry van spot rates were basically unchanged from the prior week. Rates, which are about 64 cents below the record level posted at the end of 2021, were about 9% lower than the same 2021 week but about 28% lower if an imputed fuel surcharge is excluded. Dry van load postings increased 4.9%. Volume was about 18% below the level posted in the same 2021 week but nearly 36% above the five-year average for the week.

Dry van spot rates were basically unchanged from the prior week. Rates, which are about 64 cents below the record level posted at the end of 2021, were about 9% lower than the same 2021 week but about 28% lower if an imputed fuel surcharge is excluded. Dry van load postings increased 4.9%. Volume was about 18% below the level posted in the same 2021 week but nearly 36% above the five-year average for the week.

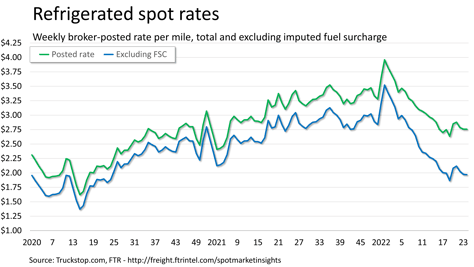

Refrigerated spot rates were flat with the previous week. Rates, which are down about $1.20 from their record at the end of 2021, were about 14% below the same 2021 week but about 30% lower excluding a fuel surcharge. Refrigerated load postings declined 1.1%. Volume was more than 23% below the same week last year but more than 53% above the five-year average for the week.

Flatbed spot rates fell 8.5 cents, which is the largest drop since the April 2020 contraction aside for a week in November last year. Rates are nearly 8% above 2021 levels but nearly 6% lower than that week if an imputed fuel surcharge is excluded. Flatbed load postings decreased 5.5%. Volume was nearly 31% below the same 2021 week but about 40% above the five-year average for the week.

Flatbed spot rates fell 8.5 cents, which is the largest drop since the April 2020 contraction aside for a week in November last year. Rates are nearly 8% above 2021 levels but nearly 6% lower than that week if an imputed fuel surcharge is excluded. Flatbed load postings decreased 5.5%. Volume was nearly 31% below the same 2021 week but about 40% above the five-year average for the week.