Spot rates ease in all segments in the latest week

Load postings in the Truckstop.com system recovered much of their holiday-week losses during the week ended June 10 (week 23), but spot rates were down in all segments. Even so, the average market rate was essentially flat because volume gains in flatbed outpaced the van segments, which are seeing far lower rates. Traditionally, the coming three weeks are among the year’s strongest for van rates, but supply chain disruptions are confounding seasonal expectations, and rates are still above average.

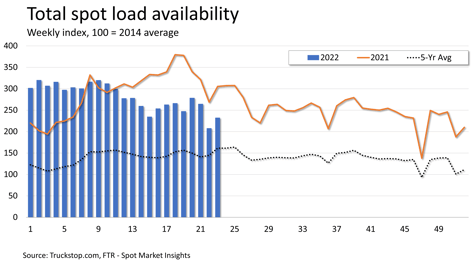

Total load postings rose 11.9% from the drop in the Memorial Day holiday week. Volume was about 12% below the week prior to the holiday. Load postings were about 24% below the same 2021 week but about 44% above the five-year average for the week. Load availability was up in all regions with particular strength in the South Central and West Coast regions. Truck postings rose nearly 21%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since November 2020.

Total load postings rose 11.9% from the drop in the Memorial Day holiday week. Volume was about 12% below the week prior to the holiday. Load postings were about 24% below the same 2021 week but about 44% above the five-year average for the week. Load availability was up in all regions with particular strength in the South Central and West Coast regions. Truck postings rose nearly 21%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since November 2020.

Note: The latest data reflects a Truckstop.com revision of the Truck Availability metric back to week 8 of this year. The new measure is a better representation of available capacity. On average, the revision increased the MDI measurement by nearly 22 points since the new measurement of truck availability is lower than the previously reported data.

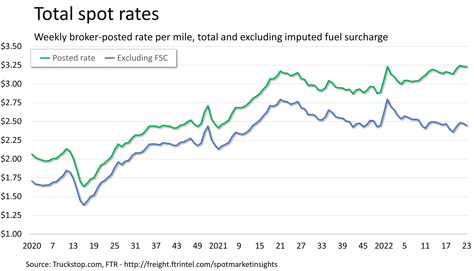

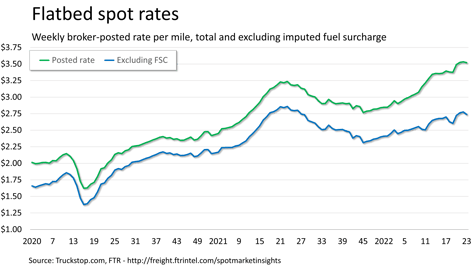

Total broker-posted rates was basically unchanged, down about 1.5 cents from the record posted two weeks earlier. Total spot rates in the system were nearly 3% ahead of the same 2021 week, but FTR estimates that excluding an imputed fuel surcharge rates would be down nearly 12% year over year. Although the broker-posted rate is just under the record, the rate excluding fuel surcharges is about 35 cents below the record.

Total broker-posted rates was basically unchanged, down about 1.5 cents from the record posted two weeks earlier. Total spot rates in the system were nearly 3% ahead of the same 2021 week, but FTR estimates that excluding an imputed fuel surcharge rates would be down nearly 12% year over year. Although the broker-posted rate is just under the record, the rate excluding fuel surcharges is about 35 cents below the record.

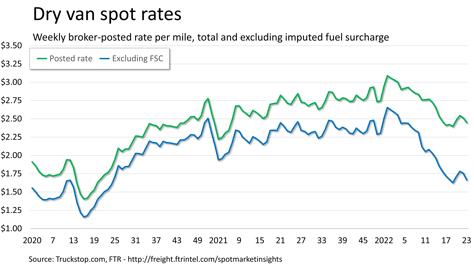

Dry van spot rates declined nearly 6.5 cents. Rates are about 64 cents below the record level posted at the end of 2021. Dry van rates were more than 10% lower than the same 2021 week but about 29% lower if an imputed fuel surcharge is excluded. Dry van load postings increased 6.8%. Volume was nearly 18% below the level posted in the same 2021 week but about 34% above the five-year average for the week.

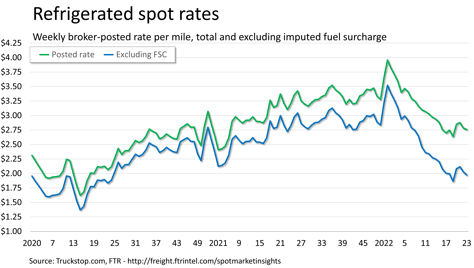

Refrigerated spot rates decreased nearly 3 cents. Rates, which are down about $1.20 from their record at the end of 2021, were about 11% below the same 2021 week but nearly 28% lower excluding a fuel surcharge. Load postings increased 6.6%. Volume was 16% below the same week last year but nearly 60% above the five-year average for the week.

Flatbed spot rates eased about 1 cent from the prior week’s record level. Flatbed rates were nearly 9% higher than the same 2021 week but about 4% lower than that week if an imputed fuel surcharge is excluded. Flatbed load postings rose 14.6%. Volume was about 29% below the same 2021 week but about 44% above the five-year average for the week.