Total spot rates rise to a record in the latest week

All segments saw rate increases in the Truckstop.com system during the week ended May 27 (week 21), and the total spot market rate surpassed the prior record set at the end of 2021. The rate increases might represent a bleed-over from the strength that always accompanies the International Roadcheck inspection event, which occurred during the prior week, but the market also is entering what is typically the strongest period of the year for rates aside from the late December holiday distortion.

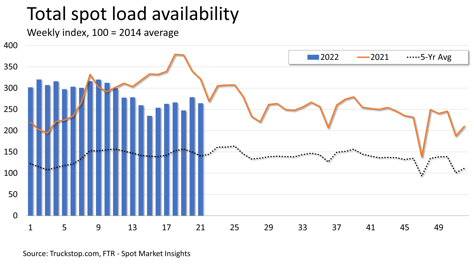

Total load postings decreased 5.0% after the big gain the prior week due to Roadcheck. Volume was nearly 18% below the same 2021 week but about 88% above the five-year average for the week. Load availability was down in all regions, but the decrease was sharpest by far in the South Central region. Truck postings increased 6.7%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell.

Total load postings decreased 5.0% after the big gain the prior week due to Roadcheck. Volume was nearly 18% below the same 2021 week but about 88% above the five-year average for the week. Load availability was down in all regions, but the decrease was sharpest by far in the South Central region. Truck postings increased 6.7%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell.

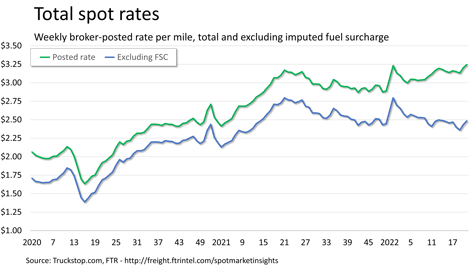

Total broker-posted rates increased more than 4 cents, resulting in the market rate exceeding the prior record by more than a penny. However, while flatbed rates are at a record level, rates in the van segments still trail their yearend 2021 records substantially. Total spot rates in the system were more than 2% ahead of the same 2021 week, but FTR estimates that excluding an imputed fuel surcharge rates would be down about 11% year over year. Although the broker-posted rate sits at a record, the rate excluding fuel surcharges is about 31 cents below the record.

Total broker-posted rates increased more than 4 cents, resulting in the market rate exceeding the prior record by more than a penny. However, while flatbed rates are at a record level, rates in the van segments still trail their yearend 2021 records substantially. Total spot rates in the system were more than 2% ahead of the same 2021 week, but FTR estimates that excluding an imputed fuel surcharge rates would be down about 11% year over year. Although the broker-posted rate sits at a record, the rate excluding fuel surcharges is about 31 cents below the record.

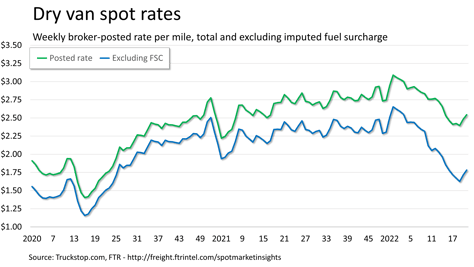

Dry van spot rates rose more than 6 cents. Rates are still down nearly 55 cents from the record level posted at the end of 2021, but they have risen nearly 15 cents over the past two weeks. Dry van rates were nearly 10% lower than the same 2021 week but about 27% lower if an imputed fuel surcharge is excluded. Dry van load postings declined nearly 4%. Volume was nearly 11% below the level posted in the same 2021 week but more than 81% above the five-year average for the week.

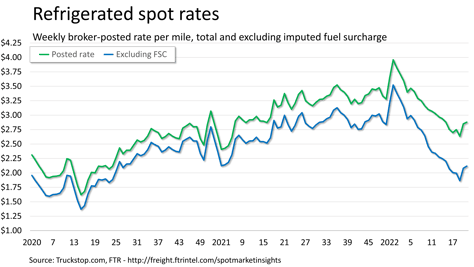

Refrigerated spot rates increased about 3 cents after soaring nearly 22 cents in the prior week. Rates are still down more than $1 from their record at the end of 2021. Refrigerated rates were nearly 15% below the same 2021 week but more than 29% lower excluding a fuel surcharge. Load postings fell about 10% after the previous week’s surge of about 41%. Volume was nearly 12% below the same week last year but more than double the five-year average for the week.

Flatbed spot rates increased about 3 cents to a record after the big jump in the prior week. Flatbed rates were about 9% higher than the same 2021 week but about 3% lower than that week if an imputed fuel surcharge is excluded. Flatbed load postings fell 4.5%. Volume was about 22% below the same 2021 week but about 89% above the five-year average for the week.