International Roadcheck supercharges the spot market

The spot market for van freight might be cooling in general, but the annual roadside inspection event known as International Roadcheck did what it always does: Drive up spot rates and volume. During the week ended May 20 (week 20), dry van and refrigerated rates in the Truckstop.com system saw their largest weekly gains since the final week of 2021 when both segments posted record rates. Flatbed spot rates, which already were at near-record levels, soared to a record.

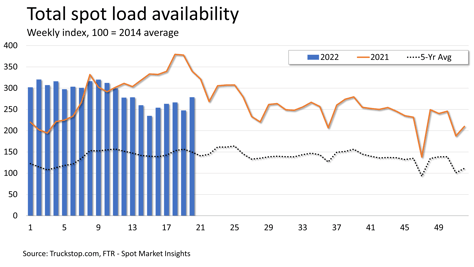

Total load postings rose 12.5%, which is the strongest gain since the beginning of the year. Volume was about 18% below the same 2021 week but 86% above the five-year average for the week. International Roadcheck, which was held May 17-19 this year, was conducted in early May last year, so the comparison to prior-year figures was relatively favorable. Truck postings declined 3.0%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – rose to its highest level in seven weeks.

Total load postings rose 12.5%, which is the strongest gain since the beginning of the year. Volume was about 18% below the same 2021 week but 86% above the five-year average for the week. International Roadcheck, which was held May 17-19 this year, was conducted in early May last year, so the comparison to prior-year figures was relatively favorable. Truck postings declined 3.0%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – rose to its highest level in seven weeks.

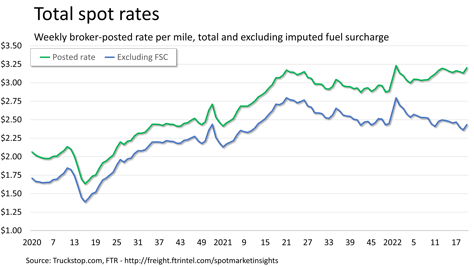

Total rates increased 7 cents even though the gains in each of the segments was considerably stronger. This odd outcome results from the fact that most of the volume growth occurred in the refrigerated and dry van segments, which are seeing rates 65 cents to $1 below flatbed. Therefore, the total average rate paid did not rise by as much as would be implied by individual segments’ increases. The broker-posted total rate was about 3% ahead of the same 2021 week, but FTR estimates that excluding an imputed fuel surcharge rates would be down nearly 11% year over year. The total spot rate is only 3 cents below the record posted at the end of 2021, but the rate excluding fuel surcharges is about 36 cents below the record.

Total rates increased 7 cents even though the gains in each of the segments was considerably stronger. This odd outcome results from the fact that most of the volume growth occurred in the refrigerated and dry van segments, which are seeing rates 65 cents to $1 below flatbed. Therefore, the total average rate paid did not rise by as much as would be implied by individual segments’ increases. The broker-posted total rate was about 3% ahead of the same 2021 week, but FTR estimates that excluding an imputed fuel surcharge rates would be down nearly 11% year over year. The total spot rate is only 3 cents below the record posted at the end of 2021, but the rate excluding fuel surcharges is about 36 cents below the record.

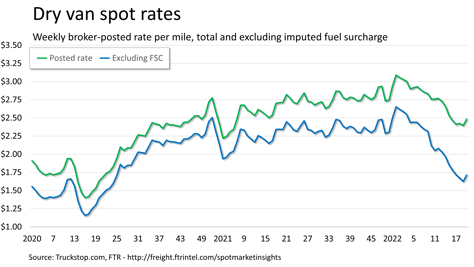

Dry van spot rates rose nearly 9 cents. Rates are down about 61 cents from the record level posted at the end of 2021. Dry van rates were nearly 9% lower than the same 2021 week but nearly 27% lower if an imputed fuel surcharge is excluded. Dry van load postings jumped about 21%, which is the strongest increase since the beginning of the year. Volume was about 11% below the level posted in the same 2021 week but 79% above the five-year average for the week.

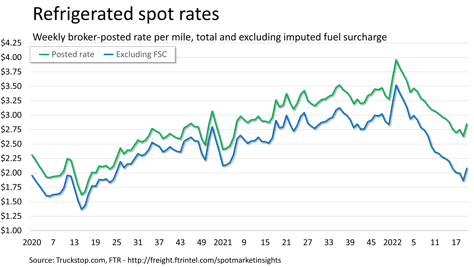

Refrigerated spot rates soared nearly 22 cents. Rates are down nearly $1.10 since hitting a record at the end of 2021. Refrigerated rates were about 10% below the same 2021 week but nearly 26% lower excluding a fuel surcharge. Load postings spiked about 41%, which is the strongest surge since November 2019. Volume was about 5% above the same week last year and about 125% above the five-year average for the week.

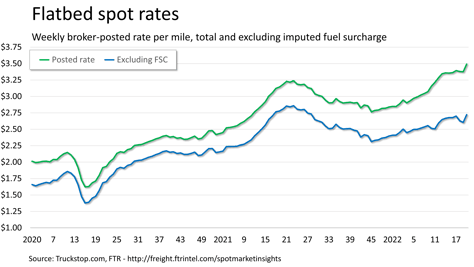

Flatbed spot rates jumped by nearly 12 cents – one of the largest increases ever posted in a single week – to a record, surpassing the prior record set three weeks earlier. Flatbed rates were nearly 10% higher than the same 2021 week but 3% lower than that week if an imputed fuel surcharge is excluded. Despite the huge rate increase, volume growth was not especially strong. Flatbed load postings increased a little more than 4%. Volume was about 25% below the same 2021 week but about 83% above the five-year average for the week.