Van spot rates halt slide as diesel prices surge

Dry van spot rates in the Truckstop.com system increased for the first time in six weeks and refrigerated spot rates rose for the first time in three months during the week ended May 6 (week 18). However, the week also saw diesel prices surge to a record. FTR estimates that excluding a calculated fuel surcharge that typically is not paid separately in spot transactions rates would have fallen in both segments. Meanwhile, flatbed spot rates eased slightly for only the third decline of the year.

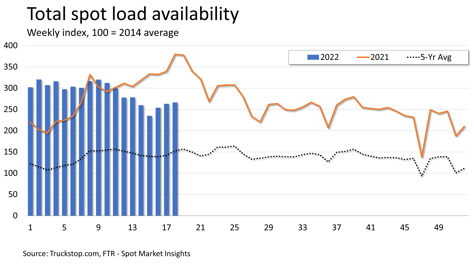

Total load postings edged up 1.2%. Volume was nearly 30% below the same 2021 week, but the comparison is distorted because the all-time high volume in week 18 last year was bolstered by the Commercial Vehicle Safety Alliance’s annual International Roadcheck roadside inspection event. Roadcheck, which this year will be held May 17-19, invariably results in stronger spot volume as driver capacity falls throughout the freight network. Volume in the latest week was about 74% higher than the five-year average. Truck postings rose 14.5% due mostly to dry van, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since November 2020.

Total load postings edged up 1.2%. Volume was nearly 30% below the same 2021 week, but the comparison is distorted because the all-time high volume in week 18 last year was bolstered by the Commercial Vehicle Safety Alliance’s annual International Roadcheck roadside inspection event. Roadcheck, which this year will be held May 17-19, invariably results in stronger spot volume as driver capacity falls throughout the freight network. Volume in the latest week was about 74% higher than the five-year average. Truck postings rose 14.5% due mostly to dry van, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since November 2020.

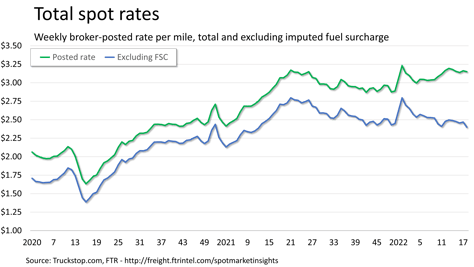

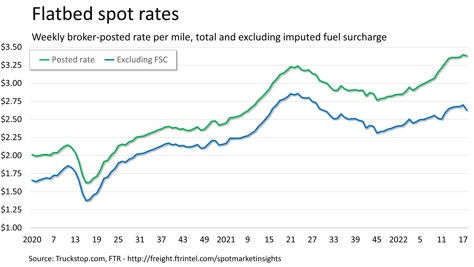

Total spot rates eased about 1 cent. The broker-posted total rate was nearly 3% ahead of the same 2021 week, but FTR estimates that excluding an imputed fuel surcharge rates would be down nearly 12% year over year. The total spot rate is only about 8 cents below the record posted at the end of 2021, but the rate excluding fuel is about 40 cents below the record.

Total spot rates eased about 1 cent. The broker-posted total rate was nearly 3% ahead of the same 2021 week, but FTR estimates that excluding an imputed fuel surcharge rates would be down nearly 12% year over year. The total spot rate is only about 8 cents below the record posted at the end of 2021, but the rate excluding fuel is about 40 cents below the record.

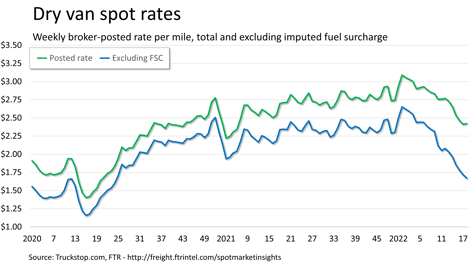

Dry van spot rates increased about 1 cent. Rates are down about 67 cents from the record level posted at the end of 2021. Dry van rates were about 10% lower than the same 2021 week but nearly 29% lower if an imputed fuel surcharge is excluded. Dry van load postings rose 8.1%, which is the strongest gain since the first week of this year. Volume was 28% below the level posted in the same 2021 week, which was strengthened by International Roadcheck, but about 67% above the five-year average for the week.

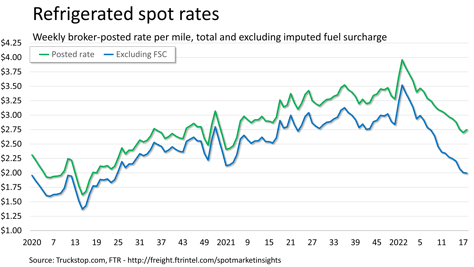

Refrigerated spot rates increased nearly 5 cents. Rates are down about $1.21 since hitting a record at the end of 2021. Refrigerated rates were nearly 16% below the same 2021 week but about 31% lower excluding a fuel surcharge. Load postings increased about 2%. Volume was about 30% lower than the Roadcheck-fueled volume during the same week last year but nearly 76% above the five-year average for the week.

Flatbed spot rates declined nearly 2 cents from the prior week’s record. Flatbed rates were about 8% higher than the same 2021 week but 5% lower if an imputed fuel surcharge is excluded. Flatbed load postings declined more than 1%. Volume was nearly 31% below the same 2021 week but about 79% above the five-year average for the week.