Spot rates continue their slide in the van segments

Flatbed spot rates rose to another record in the Truckstop.com system during the week ended April 29 (week 17), but dry van and refrigerated rates kept declining. The van segments are entering a traditionally strong period of rate gains that peaks at the end of June. Thus, the coming weeks will be key in assessing whether seasonality will halt the slide in van rates. Meanwhile, spot volume rose for the second straight week, posting the strongest two-week gain since the beginning of the year.

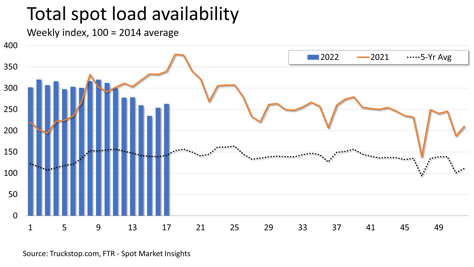

Total load postings rose 3.7%. Volume was about 22% below the same 2021 week but about 85% above the five-year average for the week. Load availability was down in only two regions: South Central and West Coast. Truck postings increased 3.1%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – ticked up slightly.

Total load postings rose 3.7%. Volume was about 22% below the same 2021 week but about 85% above the five-year average for the week. Load availability was down in only two regions: South Central and West Coast. Truck postings increased 3.1%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – ticked up slightly.

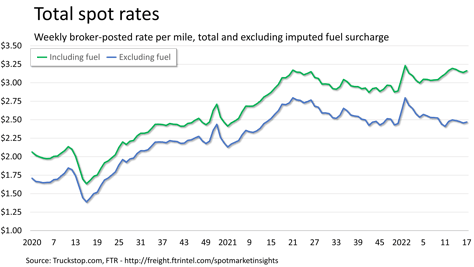

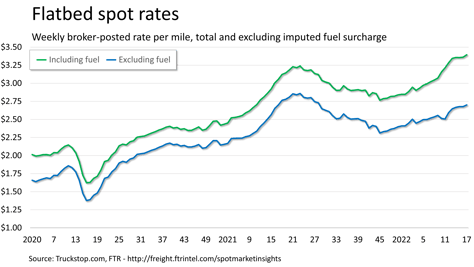

Total spot rates increased more than 2 cents due solely to flatbed’s strength. The broker-posted total rate is about 6% ahead of the same 2021 week, but FTR estimates that excluding an imputed fuel surcharge that generally is not paid in spot transactions, rates would be down nearly 6% year over year. The total spot rate is only about 7 cents below the record posted at the end of 2021, but the rate excluding fuel is nearly 33 cents below the record, which also was in the final week of 2021.

Total spot rates increased more than 2 cents due solely to flatbed’s strength. The broker-posted total rate is about 6% ahead of the same 2021 week, but FTR estimates that excluding an imputed fuel surcharge that generally is not paid in spot transactions, rates would be down nearly 6% year over year. The total spot rate is only about 7 cents below the record posted at the end of 2021, but the rate excluding fuel is nearly 33 cents below the record, which also was in the final week of 2021.

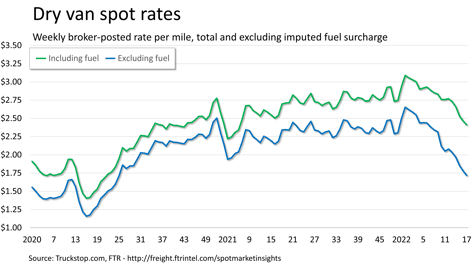

Dry van spot rates fell about 5 cents. Rates are down about 68 cents from the record level posted at the end of 2021. Dry van rates were 5% lower than the same 2021 week but more than 21% lower if an imputed fuel surcharge is excluded. Dry van load postings were essentially flat week over week. Volume was nearly 14% below the level posted in the same 2021 week but 80% above the five-year average for the week.

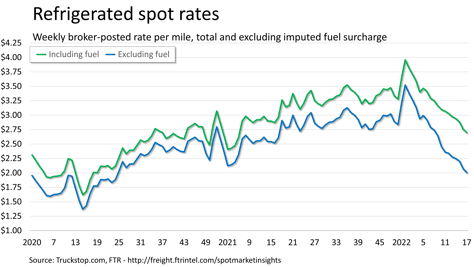

Refrigerated spot rates fell nearly 6 cents. Refrigerated rates are down about $1.26 since hitting a record at the end of 2021. Rates were about 9% below the same 2021 week but about 23% lower excluding a fuel surcharge. Refrigerated load postings increased about 6%. Volume was about 9% lower than the same week last year but more than double the five-year average for the week.

Flatbed spot rates set a second straight record, rising more than 3 cents. Flatbed rates were about 11% higher than the same 2021 week and flat with that week if an imputed fuel surcharge is excluded. Flatbed load postings rose more than 4%. Volume is nearly 28% below the same 2021 week but about 86% above the five-year average.