Van segments’ spot rates continue to fall

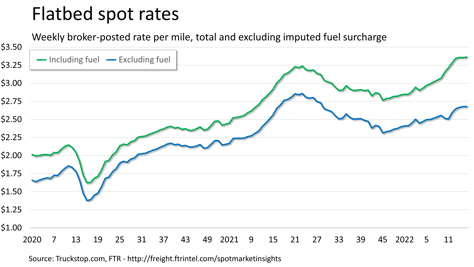

The steady cooling of spot rates in van segments continued in the latest week. While flatbed eked out a tiny increase in spot rates in the Truckstop.com system during the week ended April 22 (week 16), dry van and refrigerated spot rates fell. Rates have declined mostly steadily in both segments since hitting record levels at the end of 2021. However, total spot rates have held close to record levels owing to flatbed’s strength and to some extent the floor on rates imposed by higher diesel prices.

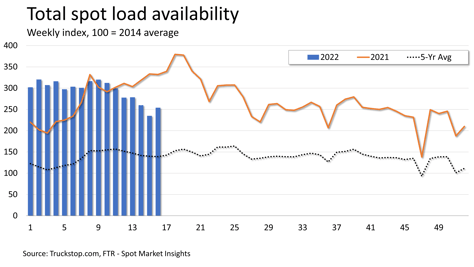

Total load postings rose 8.0%. Volume was nearly 24% below the same 2021 week but about 83% above the five-year average for the week. Load availability was higher in all regions except for the Northeast, where volume was down only about 1%. Truck postings eased 1.4%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – rose to its highest level since week 13.

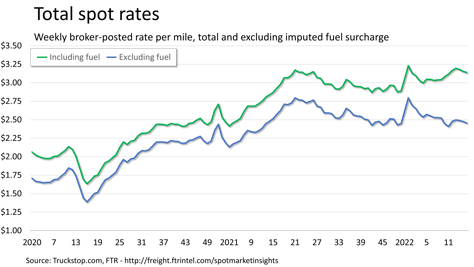

Total spot rates declined nearly 2 cents. The broker-posted total rate is about 7% ahead of the same 2021 week, but FTR estimates that excluding an imputed fuel surcharge that generally is not paid in spot transactions, rates would be down nearly 5% year over year. The total spot rate is less than 10 cents below the record posted at the end of 2021, but the rate excluding fuel is about 34 cents below the record, which also was in the final week of 2021.

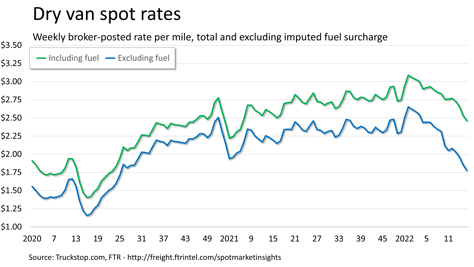

Dry van spot rates fell nearly 7 cents. Rates are down nearly 63 cents from the record level posted at the end of 2021. Dry van rates were 1.6% lower than the same 2021 week but about 17% lower if the imputed fuel surcharge is excluded. Dry van load postings increased more than 7%. Volume was about 11% below the level posted in the same 2021 week but 87% above the five-year average for the week.

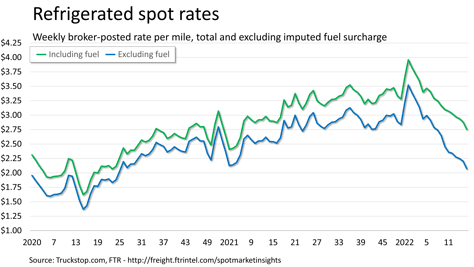

Refrigerated spot rates fell nearly 13 cents for the largest drop since January. Refrigerated rates are down about $1.20 since hitting a record at the end of 2021. Rates were about 4% below the same 2021 week but down nearly 18% excluding a fuel surcharge. Refrigerated load postings fell 6.7%. Volume was about 12% lower than the same week last year but nearly double the five-year average for the week.

Flatbed spot rates were a record, edging up a half a cent to just barely exceed the prior record posted two weeks earlier. Flatbed rates were about 12% higher than the same 2021 week and 1% higher excluding an imputed fuel surcharge. Flatbed load postings rose 12% after falling for five straight weeks. Volume is about 30% below the same 2021 week but about 82% above the five-year average.