Dry van sees largest weekly spot rate drop of the year

Dry van spot rates have eased mostly steadily since hitting a record level at the end of last year, but the decrease during the week ended April 15 (week 15) was the largest of 2022. Meanwhile, refrigerated rates rose after falling for nine straight weeks while flatbed rates were basically flat but technically down for the first time since mid-January. Although rate trends this year have varied significantly by segment, none are seeing rates offset the surge in diesel prices since late February.

Note: Beginning with next week’s commentary, we will be formally revising our estimates of recent fuel surcharges based on analysis of data since March’s unprecedented surge in diesel prices. Because of this impending change, rate charts this week do not indicate the impact of fuel surcharges, although the following discussion of rates reflects our preliminary revisions as appropriate.

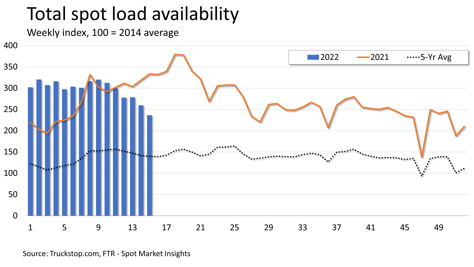

Total load postings fell 9.0%, which is the largest drop of the year. Volume was about 29% below the same 2021 week but about 69% above the five-year average for the week. Load availability was slightly higher on the West Coast but down in all other regions. If volume were to hold steady at current levels it would be negative for the entire year except for holiday periods. Truck postings fell 7.1%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since December 2020.

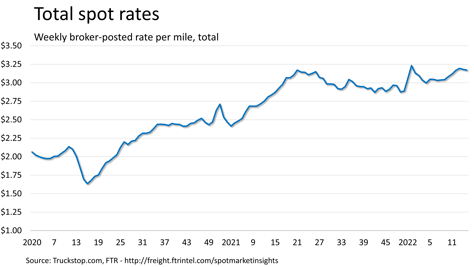

Total spot rates declined 1 cent per mile for only the second week-over-week decrease since before the historic surge in diesel prices in early March. Although the broker-posted total rate is still about 10% ahead of the same 2021 week, FTR’s revised estimate is that excluding an imputed fuel surcharge that generally is not paid in spot transactions, rates would be slightly negative year over year for the first time since June 2020.

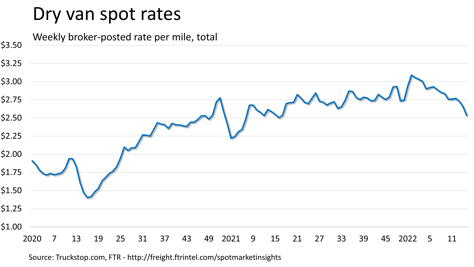

Dry van spot rates fell 12.4 cents, which is the largest drop since early December. Rates are down nearly 56 cents from the record level posted at the end of 2021. The total dry van rate was slightly negative (down 0.6%) from the year-earlier week for the first time since July 2020. Excluding fuel surcharges, dry van rates were nearly 16% below the comparable 2021 week. Dry van load postings fell about 9%. Volume was about 21% below the level posted in the same 2021 week but nearly 70% above the five-year average for the week.

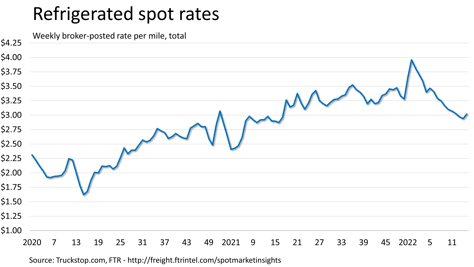

Refrigerated spot rates rose 8.1 cents for the first week-over-week increase since week 5 of the year. The segment might have benefited from pressure to stock grocery stores heading into the Easter holiday, although load volume does not reflect high demand. Refrigerated rates are down about 94 cents since hitting a record at the end of 2021. Rates were about 4% higher than the same 2021 week but down about 8% excluding a fuel surcharge. Refrigerated load postings edged up 0.8%. Volume was about 1% lower than the same week last year but 126% higher than the five-year average for the week.

Refrigerated spot rates rose 8.1 cents for the first week-over-week increase since week 5 of the year. The segment might have benefited from pressure to stock grocery stores heading into the Easter holiday, although load volume does not reflect high demand. Refrigerated rates are down about 94 cents since hitting a record at the end of 2021. Rates were about 4% higher than the same 2021 week but down about 8% excluding a fuel surcharge. Refrigerated load postings edged up 0.8%. Volume was about 1% lower than the same week last year but 126% higher than the five-year average for the week.

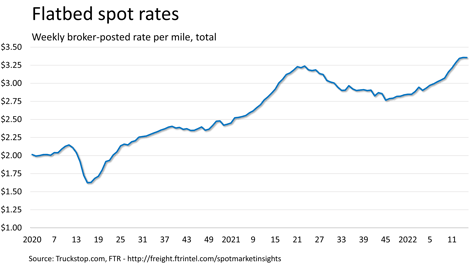

Flatbed spot rates were essentially flat, but the decline of two-tenths of a cent from the prior week’s record level technically represented the first decrease in rates in 12 weeks. Flatbed rates were about 15% higher than the same 2021 week and more than 4% higher excluding an imputed fuel surcharge. However, flatbed load postings fell for the fifth straight week, dropping 11.4%, which is the largest decrease since week 5. Volume is about 37% below the same 2021 week but about 61% above the five-year average.