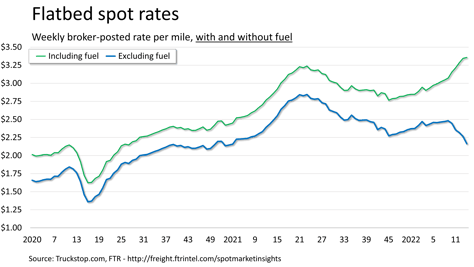

Flatbed spot rates tick up to a record while van rates keep falling

Flatbed spot rates in the Truckstop.com system set a third straight record during the week ended April 8 (week 14), but rates continued to fall in the van segments. All segments saw lower rates excluding the estimated impact of fuel. Dry van rates fell for the second straight week while refrigerated rates fell for the 13th week in the past 14. Spot load postings fell for the fourth time in five weeks. The ratio of truck postings to load postings fell to its lowest level since December 2020.

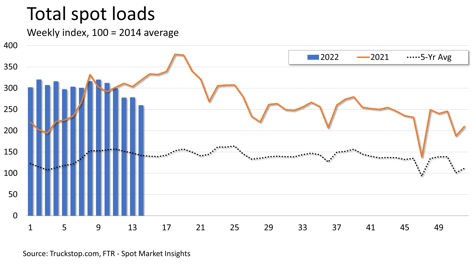

Total load postings fell 6.7% after edging up slightly in the prior week. Volume was more than 18% below the same 2021 week but about 83% above the five-year average for the week. If volume were to hold steady, it would remain negative year over year through June. Loads were up slightly in the Southeast and flat in the South Central region but were down sharply in all other regions. Truck postings increased 15.3%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since December 2020.

Total load postings fell 6.7% after edging up slightly in the prior week. Volume was more than 18% below the same 2021 week but about 83% above the five-year average for the week. If volume were to hold steady, it would remain negative year over year through June. Loads were up slightly in the Southeast and flat in the South Central region but were down sharply in all other regions. Truck postings increased 15.3%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since December 2020.

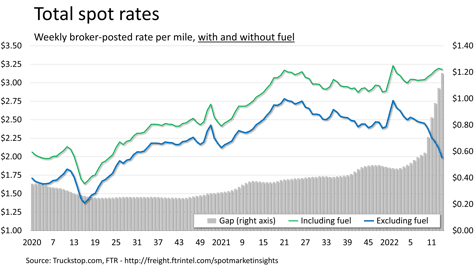

Total spot rates fell 1.4 cents per mile for the first week-over-week decline since before the historic surge in diesel prices in early March. FTR estimates that excluding an imputed fuel surcharge that generally is not paid in spot transactions, rates would have fallen nearly 13 cents. Total spot rates were about 12% higher than the same 2021 week, but excluding fuel, rates were down more than 19% year over year.

Total spot rates fell 1.4 cents per mile for the first week-over-week decline since before the historic surge in diesel prices in early March. FTR estimates that excluding an imputed fuel surcharge that generally is not paid in spot transactions, rates would have fallen nearly 13 cents. Total spot rates were about 12% higher than the same 2021 week, but excluding fuel, rates were down more than 19% year over year.

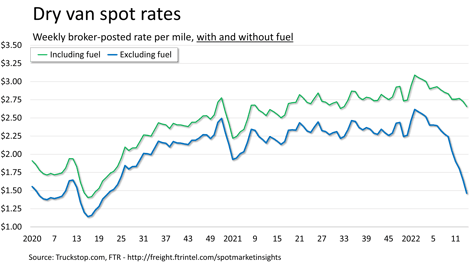

Dry van spot rates fell about 7 cents. Excluding the impact of fuel costs, rates were down nearly 19 cents. Rates have fallen about 43 cents from the record level at the end of 2021. Dry van rates were nearly 3% higher than the same 2021 week, but rates excluding fuel were down 34%. Dry van load postings fell nearly 8%. Volume was about 15% below the level posted in the same 2021 week but nearly 76% above the five-year average for the week.

Dry van spot rates fell about 7 cents. Excluding the impact of fuel costs, rates were down nearly 19 cents. Rates have fallen about 43 cents from the record level at the end of 2021. Dry van rates were nearly 3% higher than the same 2021 week, but rates excluding fuel were down 34%. Dry van load postings fell nearly 8%. Volume was about 15% below the level posted in the same 2021 week but nearly 76% above the five-year average for the week.

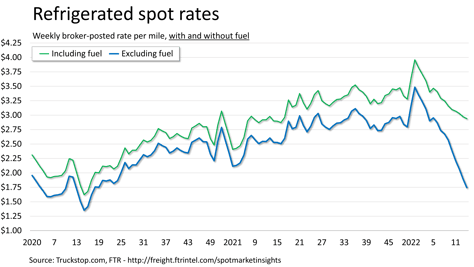

Refrigerated spot rates declined about 3 cents, but rates excluding the estimated fuel impact fell 15 cents. Rates have plunged by more than $1 a mile from the record level at the end of 2021. Refrigerated rates were 1.4% above the same 2021 week, but excluding fuel, spot rates were down 31%. Refrigerated load postings edged up about 1%. Volume was essentially flat with last year but more than double the five-year average.

Refrigerated spot rates declined about 3 cents, but rates excluding the estimated fuel impact fell 15 cents. Rates have plunged by more than $1 a mile from the record level at the end of 2021. Refrigerated rates were 1.4% above the same 2021 week, but excluding fuel, spot rates were down 31%. Refrigerated load postings edged up about 1%. Volume was essentially flat with last year but more than double the five-year average.

Flatbed spot rates increased 1.3 cents, which is the smallest gain since a decline in rates in the third week of the year. Rates set a third straight record, but excluding the impact of fuel they were down by about 10 cents. Rates were about 17% higher than the same week last year but about 13% below the same 2021 week excluding fuel. Flatbed load postings fell 7.8%, which is the sharpest drop in nine weeks. Volume was about 22% below the same week last year but about 82% above the five-year average for the week.