Spot volume edges higher as rates basically hold steady

Total load postings in the Truckstop.com system ticked up 2% during the week ended October 1 (week 39), essentially matching volume during the week before the July 4th holiday. Dry van led the way for the three principal segments, while refrigerated load postings edged slightly higher and flatbed volume eased slightly. Total spot rates declined less than 1 cent from the prior week, although a third straight decline in refrigerated rates was mostly offset by gains in other segments.

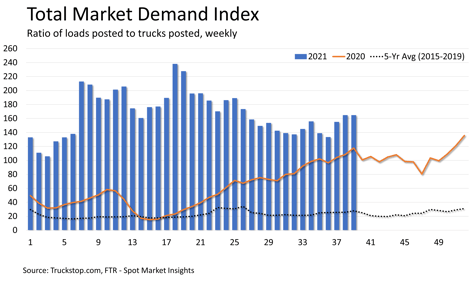

Spot market volume generally continues to outpace seasonal expectations. For example, while volume in the latest week was basically the same as the end of June, the five-year average (2015-2019) change between week 26 and week 39 is a decrease of more than 15%. Total volume during week 39 was about 31% higher than the same 2020 week, which saw the peak of volume in the Truckstop.com system for all of 2020.

In an unusual occurrence, total truck postings rose by the same degree as load postings. The Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – was unchanged at its highest level since the end of June. However, the dry van MDI rose while the MDIs for refrigerated and flatbed fell.

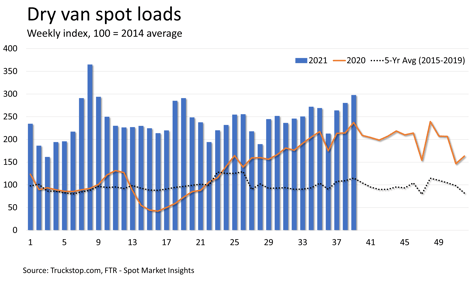

Dry van load postings increased 6.2%, basically matching the gain in the previous week. Volume surpassed that posted during the International Roadcheck disruption in May and was the second highest dry van volume ever after the week 8 spike due to extreme winter weather. Load postings were nearly about 26% above the same 2020 week and about 159% above the five-year average for the week.

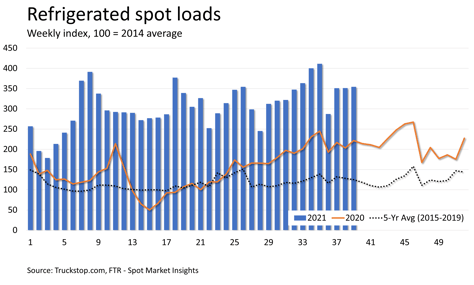

Refrigerated load volume was up 0.8% after no change during the prior week. Refrigerated load postings have essentially stalled at a higher level since the rebound from Labor Day week, which had followed record refrigerated volume in week 35. Refrigerated volume was about 60% higher than the same week last year and about 183% above the five-year average.

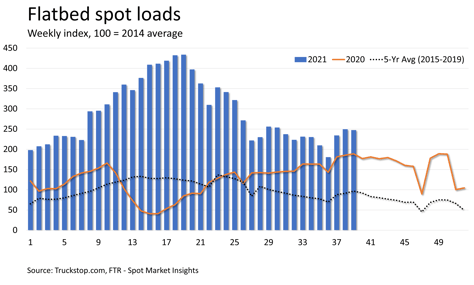

Flatbed load postings declined 0.8% after a 6.5% gain during the prior week. Flatbed has been essentially following seasonal expectations directionally, albeit at highly elevated levels. Flatbed volume was about 31% higher than the same week last year and about 156% higher than the five-year average. If flatbed continues to follow seasonality, volume will ease gradually for the rest of the year.

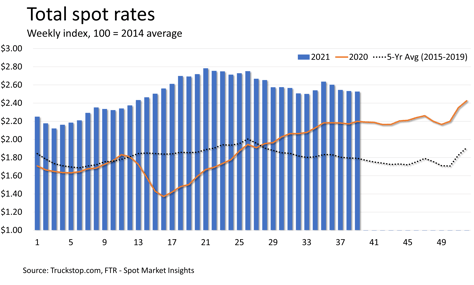

Total spot rates declined for the fourth straight week, although the latest decrease was small. The broker-posted rate per mile excluding fuel surcharges declined by about half a cent. Rates excluding fuel were about 15% higher than the same 2020 week. However, diesel prices are running about $1 higher than they were a year ago, and total spot rates including fuel were about 20% higher than the same 2020 week. Dry van rates excluding fuel were up about 3 cents and were about 9% higher than rates in the same week last year. Refrigerated rates fell nearly 8 cents and were about 22% higher than the same 2020 week. Flatbed rates were basically unchanged for the second straight week and were about 16% higher than the same week last year.