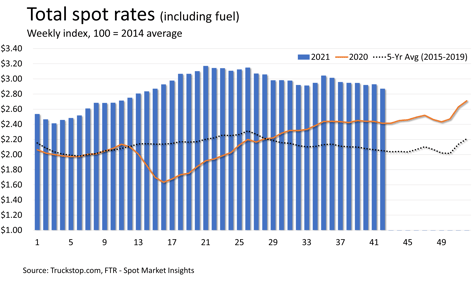

Rates fall sharply, but spot volume still outpaces seasonal expectations

Total spot rates in the Truckstop.com system dropped 6 cents a mile – the largest decline in three months – during the week ended October 22 (week 42). Rates were basically flat in dry van, but flatbed and refrigerated saw fairly sharp declines. Total spot load postings eased about 1%, but the five-year (2015-2019) average decline for week 42 is 3.7%. Among the key segments, flatbed accounted for the weakness as dry van volume was up and refrigerated volume was barely below flat.

Spot rates remain extraordinarily strong at 19% over the same week last year, but a huge share of that healthy comparison is the recent surge in diesel prices. Excluding fuel surcharges, spot rates were up about 11% from the same 2020 week. Diesel prices in the latest week were more than $1.28 higher than they were in the same week last year. Dry van rates, which eased less than a half cent, were nearly 15% higher year over year. Refrigerated rates declined nearly 8 cents but were nearly 23% higher than the same 2020 week. Flatbed rates also fell 8 cents but were about 20% higher than the same week last year. Excluding fuel surcharges, the year-over-year comparisons for dry van, refrigerated, and flatbed rates were about 6%, 16%, and 12%, respectively.

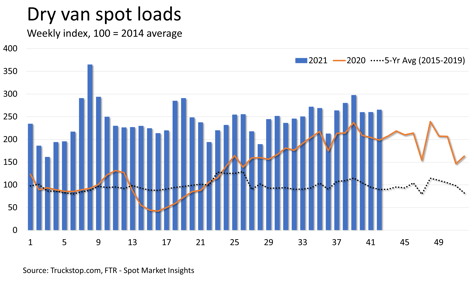

Dry van was the only segment to post a gain in volume from the prior week as loads postings were up 2%. On average, dry van volume declines 5.3% in week 42, so the segment continued to outpace seasonal expectations, which is not surprising given the ongoing disruptions in the supply chain. Load postings were about 34% higher than the same week last year and nearly triple the five-year average.

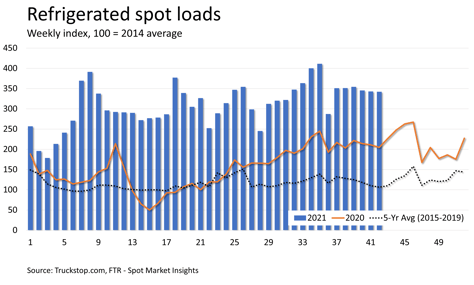

Refrigerated volume was basically flat, easing just 0.2% after a slightly larger decline during the prior week. The five-year average decline for week 42 is 3.6%, so refrigerated, like dry van, is performing better than seasonal expectations. Refrigerated load postings were 67% higher than the same 2020 week and about 222% higher than the five-year average.

Refrigerated volume was basically flat, easing just 0.2% after a slightly larger decline during the prior week. The five-year average decline for week 42 is 3.6%, so refrigerated, like dry van, is performing better than seasonal expectations. Refrigerated load postings were 67% higher than the same 2020 week and about 222% higher than the five-year average.

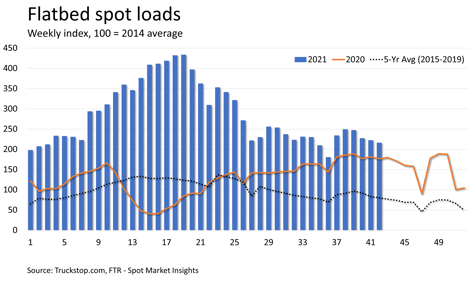

Flatbed load postings fell 2.8% after declining 2.1% in the prior week. On average, flatbed volume declines 3.6% during week 42, so the segment still outpaced expectations slightly. Flatbed is seeing less upside pressure on volume due to supply chain disruptions than the van markets are. Flatbed volume was about 22% higher than the same week last year and about 169% higher than the five-year average.