Spot volume eases slightly, outpacing seasonal expectations

Total load postings in the Truckstop.com system dipped 1.1% during the week ended October 15 (week 41), which is notably stronger than expected during the week if the market were moving seasonally. Dry van volume was flat week over week, and the declines in refrigerated and flatbed were smaller than they had been in the previous week. Truck postings were modestly higher. Total spot rates rose slightly for the first time in six weeks, but the increase was due entirely to rising fuel costs.

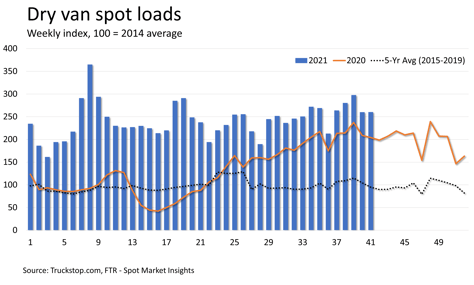

Ongoing supply chain challenges continue to bolster spot freight, especially in the van markets. Freight transportation became national news last week when the White House announced steps that various stakeholders would take to relieve the severe congestion at the ports of Los Angeles and Long Beach. While those steps eventually might stabilize the situation, the near-term effect – if any – likely would be to put even more pressure on intermodal and dry van as the transportation system struggles to process accelerated container movements from ships to shore. The intermodal system already struggles with rail congestion, so increased transloading to dry van might be necessary.

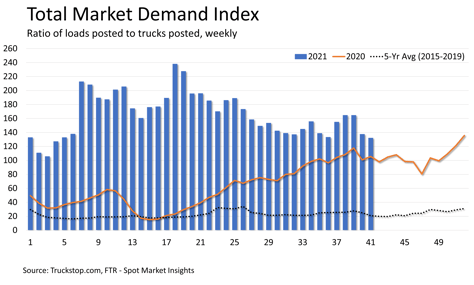

Trucking postings rose 3.0%. The Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – declined slightly to its lowest level since late January. The MDI was down in all segments, but the decline in flatbed was slight.

Dry van load postings were unchanged after a 12.6% drop in the prior week. On average, dry van volume declines about 9% in week 41, so the segment outpaced seasonal expectations, which is not surprising. Load postings were about 28% higher than the same week last year and about 174% above the five-year average.

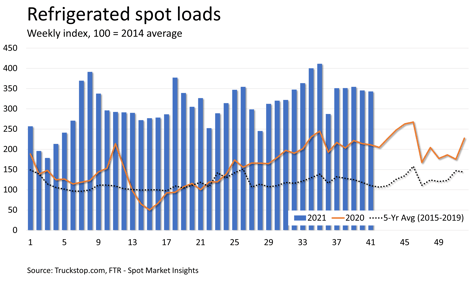

Refrigerated volume dipped 0.8% after easing 2.5% the week before. The five-year average decline for week 41 is nearly 7%, so refrigerated, like dry van, significantly outpaced seasonal expectations. Refrigerated load postings were 63% higher than the same 2020 week and more than double the five-year average.

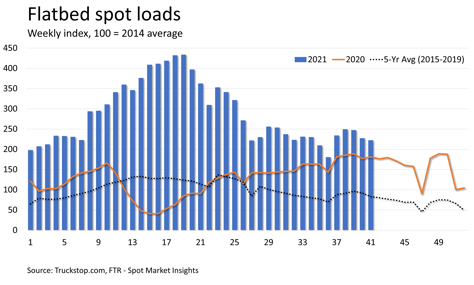

Flatbed load postings fell 2.1% after dropping 8.1% in the prior week. However, the decline in flatbed volume on average is nearly 10% for week 41, so the segment outpaced seasonality. Flatbed volume was about 23% higher than the same week last year and about 167% higher than the five-year average.

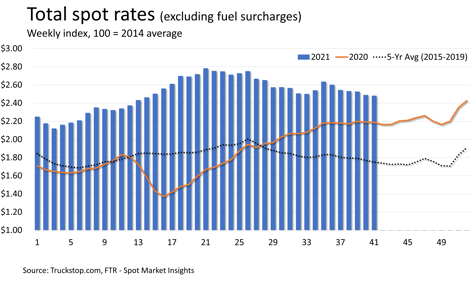

Total spot rates edged up 1 cent – the first increase in six weeks. However, the gain was solely due to sharply higher diesel prices, which are up 18 cents per gallon in the past two weeks. Excluding fuel surcharges, broker-posted rate per mile declined by about 1 cent. Rates excluding fuel were about 14% higher than the same 2020 week while rates including fuel were up 20%. Dry van rates excluding fuel declined by about 6 cents and were about 6% higher than rates in the same week last year. Refrigerated rates recovered about 6 cents of the previous week’s decrease of about 14 cents. Refrigerated rates were about 18% higher than the same 2020 week. Flatbed rates eased about 1 cent and were about 15% higher than the same week last year.