Spot volume rebounds after Labor Day week, but rates decline

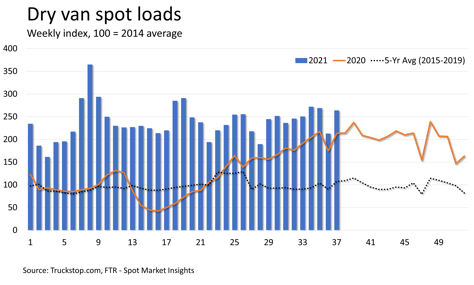

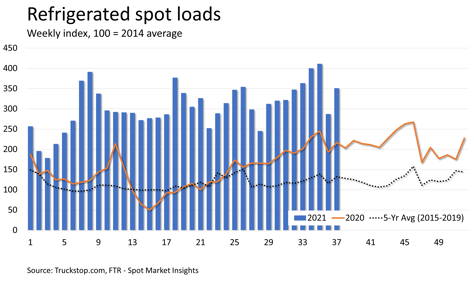

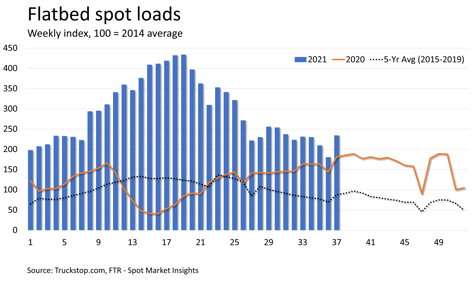

Load postings in the Truckstop.com system bounced back from a Labor Day-induced lull during the week ended September 17 (week 37). Total spot volume jumped 25.9% to exceed the volume recorded during the week prior to Labor Day. The principal segments – dry van, refrigerated, and flatbed – each posted gains of more than 20%, although dry van and refrigerated volume did not recover all the volume lost during the holiday week. Meanwhile, total spot rates posted their largest decline in five weeks.

Volume in the latest week was about 29% above the same 2020 week and about 153% above the five-year average (2015-2019). The holiday outlier aside, total spot load postings have held mostly steady since early July – a trend that generally outpaces seasonal expectations. The situation seems unlikely to change much soon given continued supply chain disruption. The three largest segments remain well above last year’s volume, but the specialized segment in week 37 was significantly below prior-year levels for the first time this year.

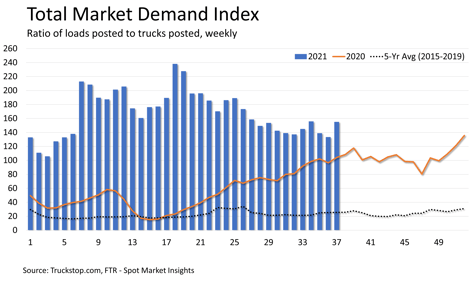

Truck postings rose 8.2%, which is only about half of the 16.2% decline of the prior week. With the gain in capacity not matching volume growth, the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – rose to nearly the level recorded three weeks earlier. Among the three largest segments, flatbed was mostly responsible for the increase in truck postings.

Truck postings rose 8.2%, which is only about half of the 16.2% decline of the prior week. With the gain in capacity not matching volume growth, the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – rose to nearly the level recorded three weeks earlier. Among the three largest segments, flatbed was mostly responsible for the increase in truck postings.

Dry van load postings rose 23.9% after falling 20.9% during the holiday week. Volume in the latest week was about 2% below the volume recorded during in the week before Labor Day. Volume was nearly 24% above the same 2020 week and about 145% above the five-year average for the week.

Refrigerated load volume increased 22.3% after dropping 30.2% in the holiday week. Load postings were nearly 15% below week 35’s record level. Refrigerated spot volume tends to be soft following Labor Day until it spikes in the run-up to Thanksgiving. Volume was about 62% higher than the same week last year and about 165% above the five-year average.

Flatbed load postings jumped 29.8% after falling 13.9% during the holiday week. While dry van and refrigerated fell short of their pre-holiday volumes, flatbed load postings were nearly 12% ahead of week 35. Flatbed volume was about 29% higher than the same week last year and about 166% higher than the five-year average.

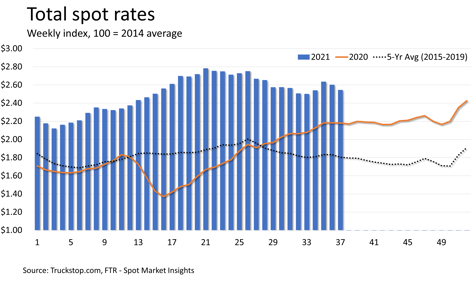

The broker-posted rate per mile excluding fuel surcharges declined nearly 6 cents for the largest decrease in five weeks. Rates are about 17% higher than the same 2020 week. Dry van rates fell more than 8 cents and are 10% higher than rates in the same week last year. Refrigerated rates also were down a little more than 8 cents from the prior week’s record level and were about 24% higher than the same 2020 week. Flatbed rates declined nearly 3 cents and were nearly 18% higher than the same week last year.