Labor Day takes a big bite out of spot volume and capacity

Spot volume during the week that included Labor Day fell by the largest degree since Christmas week last year, and truck postings fell by the most since extreme winter weather in February. Total load postings in the Truckstop.com system plunged 19.6% and truck postings fell 16.2% during the week ended September 10 (week 36). Volume and capacity were down sharply in all freight segments. Total spot rates also fell week over week, but refrigerated rates rose to their second straight record.

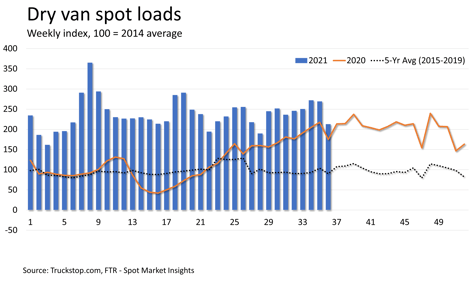

Although holidays always depress spot volume and capacity, the impact likely was larger because volume heading into Labor Day has been stronger than typical – especially in the van markets – owing to general supply chain and labor disruptions and the consequences of Hurricane Ida. Total load volume was about 26% above the same 2020 week, which is the tightest year-over-year comparison since late October last year. Volume was about 144% above the five-year average (2015-2019).

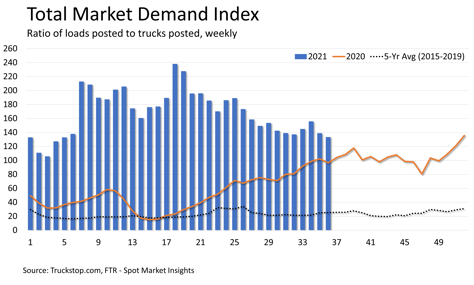

Truck postings fell 16.2%, which is the largest decline since truck capacity plunged 26.2% in February in the wake of extreme winter weather throughout much of the U.S. With both volume and capacity falling sharply, the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – was little changed from the prior week. However, in flatbed the decline in truck postings outpaced the drop in load postings, so the MDI moved a bit higher.

Truck postings fell 16.2%, which is the largest decline since truck capacity plunged 26.2% in February in the wake of extreme winter weather throughout much of the U.S. With both volume and capacity falling sharply, the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – was little changed from the prior week. However, in flatbed the decline in truck postings outpaced the drop in load postings, so the MDI moved a bit higher.

Dry van load postings fell 20.9% after easing 1.0% during the prior week. Dry van volume was about 22% above the same 2020 week, which is the tightest year-over-year comparison in more than a year. Volume was about 136% above the five-year average for the week.

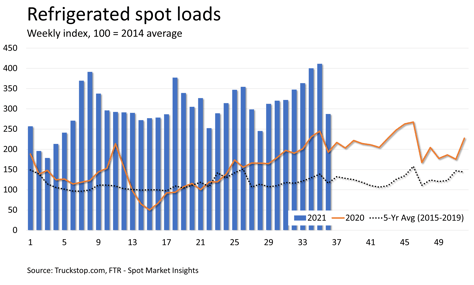

Refrigerated load volume dropped 30.2% from the prior week’s record level. Volume was about 49% higher than the same week last year and about 147% above the five-year average. The latest week was the first since early July that refrigerated volume was not higher than it was during the previous week.

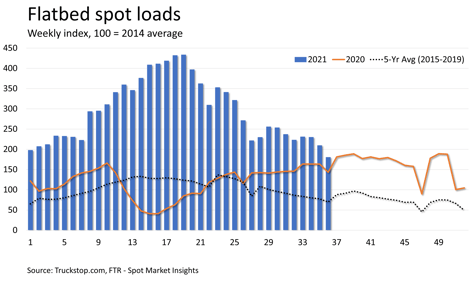

Flatbed load postings fell 13.9% after an 8.9% decrease during the prior week. Flatbed load volume was the lowest since the final week of 2020. Volume was 26% higher than the same week last year and 159% higher than the five-year average.

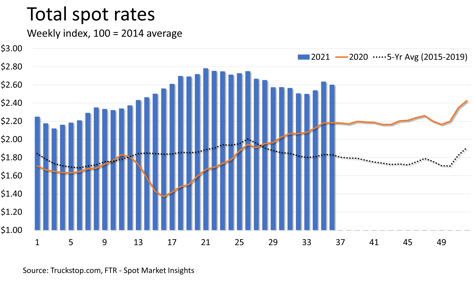

The broker-posted rate per mile excluding fuel surcharges declined more than 3 cents but was about 19% higher than the same 2020 week. Although dry van and flatbed rates were down, refrigerated rates were up about 4 cents to another record and were 26% higher than the same week last year. Dry van rates declined just 1 cent and were about 14% above the same week last year. Flatbed rates were down nearly 5 cents but were up about 20% over the same 2020 week.

The broker-posted rate per mile excluding fuel surcharges declined more than 3 cents but was about 19% higher than the same 2020 week. Although dry van and flatbed rates were down, refrigerated rates were up about 4 cents to another record and were 26% higher than the same week last year. Dry van rates declined just 1 cent and were about 14% above the same week last year. Flatbed rates were down nearly 5 cents but were up about 20% over the same 2020 week.