Weaker flatbed spot metrics offset small gains elsewhere

After the prior week’s rebound, spot volume in the Truckstop.com system was little changed during the week ended July 30 (week 30), rising 0.9%. A decline of nearly 1% in flatbed volume offset much of the nearly 3% gain in the dry van and refrigerated segments. Lower flatbed spot rates also offset small gains in other segments as total rates were essentially unchanged. Truck postings rose nearly 9%, and the ratio of loads to trucks in the system fell to its lowest level since early February.

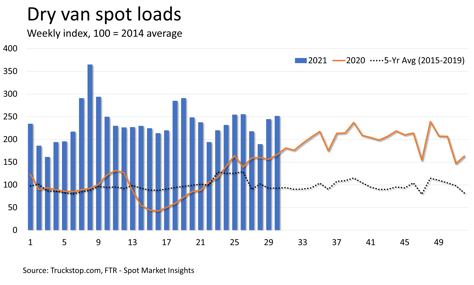

Spot volume and rates so far are slightly outperforming seasonal expectations for the second half of the year, but given ongoing disruptions in the freight markets, those expectations might not be as meaningful as they were before March 2020. Of course, regardless of their week-to-week movements, spot volume and rates remain well above last year’s levels and the five-year (2015-2019) average.

Total load postings were about 66% higher than the same 2020 week and 163% above the five-year average. Truck postings rose 8.8%, mostly due to a sharp gain in dry van and, to a lesser degree, refrigerated. The Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since the week in early February immediately prior to the surge in demand related to winter weather disruptions.

Total load postings were about 66% higher than the same 2020 week and 163% above the five-year average. Truck postings rose 8.8%, mostly due to a sharp gain in dry van and, to a lesser degree, refrigerated. The Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since the week in early February immediately prior to the surge in demand related to winter weather disruptions.

Dry van load postings increased 2.9% after the prior week’s 29.1% gain. Dry van volume was about 51% above the same 2020 week and 171% above the five-year average for the week. Dry van truck postings rose 25.4% after the 27.1% gain the week before, and the dry van MDI fell to roughly the same level as week 23 of the year.

Refrigerated load postings moved up 2.5% after the prior week’s 27.4% increase. Refrigerated volume was about 78% higher than the same 2020 week and nearly double the five-year average. Refrigerated truck postings increased 13.8%, and the refrigerated MDI fell to its lowest level since week 23.

Refrigerated load postings moved up 2.5% after the prior week’s 27.4% increase. Refrigerated volume was about 78% higher than the same 2020 week and nearly double the five-year average. Refrigerated truck postings increased 13.8%, and the refrigerated MDI fell to its lowest level since week 23.

Flatbed load postings decreased 0.9% after an 11.3% gain in the prior week. Volume was about 76% higher than the same week last year and about 165% higher than that the five-year average. Flatbed truck postings were flat, and the flatbed MDI dipped slightly due to the small decline in volume.

Flatbed load postings decreased 0.9% after an 11.3% gain in the prior week. Volume was about 76% higher than the same week last year and about 165% higher than that the five-year average. Flatbed truck postings were flat, and the flatbed MDI dipped slightly due to the small decline in volume.

For the first time since the end of June, total spot rates did not fall week over week. The broker-posted rate per mile excluding fuel surcharges held essentially flat and was 27% above the same 2020 week. Dry van rates were up nearly 3 cents and were about 20% higher than the 2020 week. Refrigerated rates rose about 6 cents and were about 26% higher than the same week last year. Flatbed rates were down about 2 cents and were about 31% ahead of the same 2020 week.

For the first time since the end of June, total spot rates did not fall week over week. The broker-posted rate per mile excluding fuel surcharges held essentially flat and was 27% above the same 2020 week. Dry van rates were up nearly 3 cents and were about 20% higher than the 2020 week. Refrigerated rates rose about 6 cents and were about 26% higher than the same week last year. Flatbed rates were down about 2 cents and were about 31% ahead of the same 2020 week.