Spot volume and rates surge during International Roadcheck week

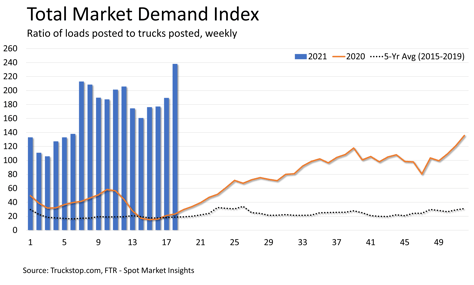

Load postings and rates in the Truckstop.com system already were at record levels when the spot market faced one of its biggest annual stress events: The Commercial Vehicle Safety Alliance’s International Roadcheck. The three-day driver/vehicle inspection spree occurred during the week ended May 7 (week 18), resulting in sharp increases in volume and rates and a sharp drop in truck postings. Thus, week 18 saw records for loads, rates, and the Market Demand Index – the ratio of loads to trucks.

International Roadcheck historically has been one of the hottest weeks of the year for the spot market as the event generally has encouraged truck drivers to take time off. The result usually is that shippers and brokers must seek more capacity in the spot market, which itself usually sees sharply reduced capacity. Until last year, Roadcheck had always occurred in early June. Last year, CVSA had rescheduled the event for early May, although it ultimately was postponed until September due to the pandemic.

Total volume rose 11.8% during week 18 for the strongest gain since the weather-related spike in week 8. Truck postings fell 11.1%, which is the biggest drop since week 7. As a result, the MDI jumped sharply to its strongest level ever, surpassing the prior record set in week 7 of this year.

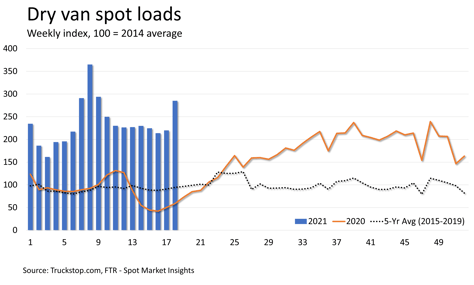

Dry van load postings jumped 29.6% for its largest increase since week 7. Volume was about 22% below the record level, which was posted in week 8 during the weather-related surge. Load postings were about 384% higher than the same 2020 week and about triple the five-year average (2015-2019). Dry van truck postings fell nearly 10%, and the dry van MDI rose to the highest level in 10 weeks.

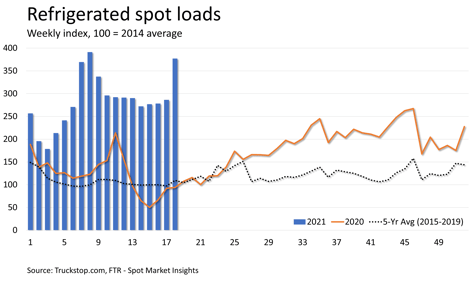

Refrigerated load postings soared 31.7% for the largest increase since week 7. As with dry van, refrigerated volume fell short of its week 8 record but only by 3.6%. Volume was about four times the same 2020 week and 244% higher than the five-year average. Refrigerated truck postings fell 19.8%, resulting in the highest refrigerated MDI in 12 weeks.

Refrigerated load postings soared 31.7% for the largest increase since week 7. As with dry van, refrigerated volume fell short of its week 8 record but only by 3.6%. Volume was about four times the same 2020 week and 244% higher than the five-year average. Refrigerated truck postings fell 19.8%, resulting in the highest refrigerated MDI in 12 weeks.

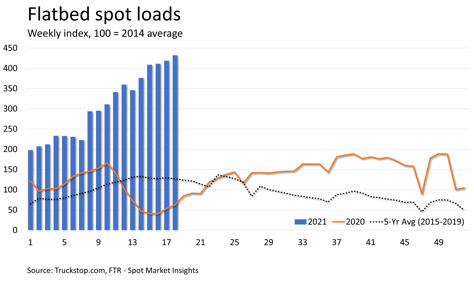

Flatbed load postings increased 3.2% to set the 10th volume record in 11 weeks. Load volume was 585% higher than the same 2020 week and nearly 240% higher than the five-year average. Flatbed did not experience the surge in volume that dry van and refrigerated did, but the 11.4% drop in truck postings was unusual and resulted in a sharp increase in the MDI over the prior week’s record level.

Flatbed load postings increased 3.2% to set the 10th volume record in 11 weeks. Load volume was 585% higher than the same 2020 week and nearly 240% higher than the five-year average. Flatbed did not experience the surge in volume that dry van and refrigerated did, but the 11.4% drop in truck postings was unusual and resulted in a sharp increase in the MDI over the prior week’s record level.

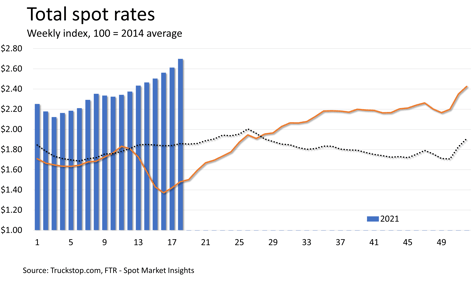

The broker-posted rate per mile excluding fuel surcharges rose nearly 9 cents for the largest gain since late last year. Total spot rates were about 82% higher than the same 2020 week. Dry van’s increase of nearly 16 cents was the largest since week 8. Dry rates were about 89% above the same week last year. Refrigerated rates rose to a record level with a surge of 30 cents – the largest gain since late 2020. Refrigerated rates were about 65% higher than the same 2020 week. Flatbed rates also set another record, but the increase of 6.5 cents was not extraordinarily strong compared to recent history. Flatbed rates were about 92% higher than the same week last year.

The broker-posted rate per mile excluding fuel surcharges rose nearly 9 cents for the largest gain since late last year. Total spot rates were about 82% higher than the same 2020 week. Dry van’s increase of nearly 16 cents was the largest since week 8. Dry rates were about 89% above the same week last year. Refrigerated rates rose to a record level with a surge of 30 cents – the largest gain since late 2020. Refrigerated rates were about 65% higher than the same 2020 week. Flatbed rates also set another record, but the increase of 6.5 cents was not extraordinarily strong compared to recent history. Flatbed rates were about 92% higher than the same week last year.