Spot market volume, rates set another record

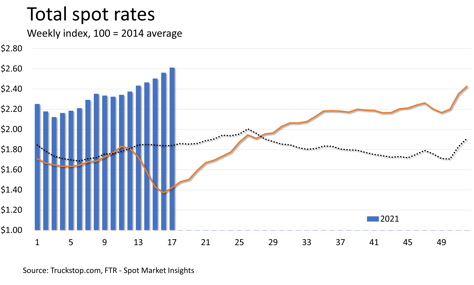

After easing very slightly the week before, spot volume in the Truckstop.com system increased 2.2% during the week ended April 30 (week 17) to surpass the record set two weeks earlier. Spot rates excluding fuel also rose to set a record for the fourth straight week. For the first time in weeks, both load postings and rates were stronger in all segments. Meanwhile, truck postings saw their second-largest decline in 11 weeks, sending the ratio of loads to trucks to its highest level in six weeks.

Although extraordinary, the spot market’s strength is not surprising given robust economic indicators and the huge stimulus that hit consumers in March. The Bureau of Economic Analysis on Friday released data showing that March’s surge in consumer spending was the largest since June. Meanwhile, a fading pandemic and increased vaccinations have led to sharply stronger sales and employment at restaurants and other businesses involved in leisure and hospitality. Flatbed especially is benefiting from strong housing starts, which are running at their strongest level since the middle of 2006. A combination of strong sales and supply chain disruptions have left retail inventories the leanest on record. These upward pressures on freight demand come as payroll employment in trucking still lags pre-employment levels significantly, further fueling the need for spot capacity.

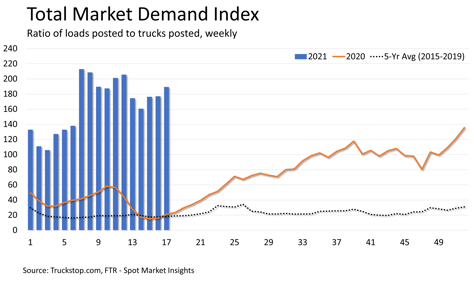

Total volume during week 17 was about 435% above the same 2020 week. Load postings were about 194% above the five-year average (2015-2019) for the week. Truck postings fell 4.5%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – rose to its highest level since week 12.

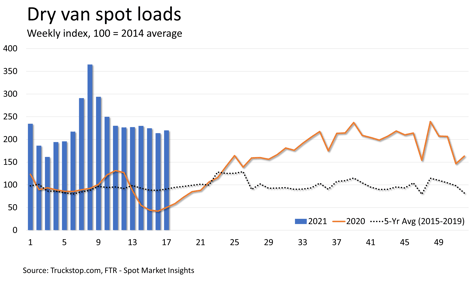

Dry van load postings increased 2.8% for the first gain in three weeks. Dry van volume continues to hold fairly steady at strong levels since stabilizing from its February spike. Load postings were about 338% higher than the same 2020 week and about 142% above the five-year average. Dry van truck postings fell 4.9%, and the dry van MDI rose to the highest level in four weeks.

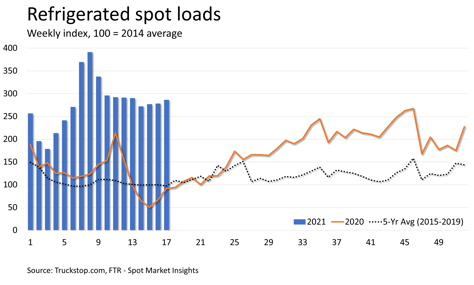

Refrigerated load postings rose 2.9%. As is the case with dry van, refrigerated volume is largely stable at very strong levels. Volume was more than triple the same 2020 week and nearly triple the five-year average. Refrigerated had seen the sharpest rebound from bottom during April last year, although by May that recovery slowed somewhat. Refrigerated truck postings fell 6.5%, resulting in the highest refrigerated MDI in six weeks.

Refrigerated load postings rose 2.9%. As is the case with dry van, refrigerated volume is largely stable at very strong levels. Volume was more than triple the same 2020 week and nearly triple the five-year average. Refrigerated had seen the sharpest rebound from bottom during April last year, although by May that recovery slowed somewhat. Refrigerated truck postings fell 6.5%, resulting in the highest refrigerated MDI in six weeks.

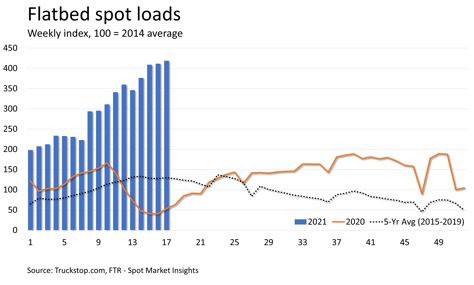

Flatbed load postings increased 1.8% to set the ninth volume record in 10 weeks. Load volume was nearly seven times the same 2020 week and 223% higher than the five-year average. Truck postings eased fell 8.1% – the largest reduction since the February weather event – and the flatbed MDI jumped to a record level.

Flatbed load postings increased 1.8% to set the ninth volume record in 10 weeks. Load volume was nearly seven times the same 2020 week and 223% higher than the five-year average. Truck postings eased fell 8.1% – the largest reduction since the February weather event – and the flatbed MDI jumped to a record level.

The broker-posted rate per mile excluding fuel surcharges increased about 5 cents and was nearly 84% higher than the same 2020 week. Flatbed rates set another record, rising 5 cents to a level that was nearly double the rate in the same 2020 week. Refrigerated rates rose more than 9 cents and were about 60% above the same week last year. While very strong, refrigerated rates remain about 25 cents below the record set at the end of 2017 when extreme winter weather added to the usual rate pressures due to holiday-related capacity shortfalls. Dry van rates increased nearly 4 cents and were about 88% higher than the same 2020 week. Dry van rates are about 17 cents below the record set during the week 8 surge.

The broker-posted rate per mile excluding fuel surcharges increased about 5 cents and was nearly 84% higher than the same 2020 week. Flatbed rates set another record, rising 5 cents to a level that was nearly double the rate in the same 2020 week. Refrigerated rates rose more than 9 cents and were about 60% above the same week last year. While very strong, refrigerated rates remain about 25 cents below the record set at the end of 2017 when extreme winter weather added to the usual rate pressures due to holiday-related capacity shortfalls. Dry van rates increased nearly 4 cents and were about 88% higher than the same 2020 week. Dry van rates are about 17 cents below the record set during the week 8 surge.