Holiday drags down spot loads, but rates keep rising.

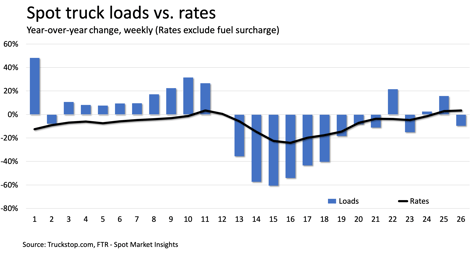

Total spot load postings in the Truckstop.com system fell for the first time in five weeks during the week ended July 3 (week 26), but the federal holiday on July 3 is fully responsible for the decline. Expect spot volume in week 27 to be sharply higher week over week as it will take a couple of weeks to get past the holiday distortion. Meanwhile, total spot rates rose for the 10th straight week. Rates were up in all segments, but the increases were especially strong in dry van and refrigerated.

Total load volume was down more than 16% from the prior week after surging nearly 70% in the four prior weeks. All three key segments saw double-digit percentage declines from the prior week. Total volume in week 26 was about 10% lower than the same week last year but still about 2% above the five-year average for the week despite the federal holiday, which usually occurs in week 27. The Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – did not quite match the two-year high seen in week 25, but with truck availability lower, it remained at the second-highest level in two years.

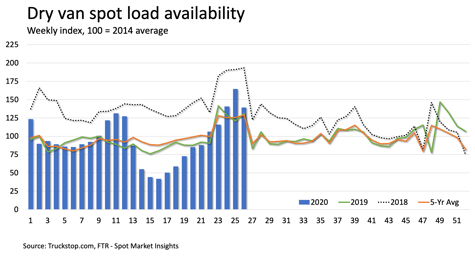

Dry van spot volume was down nearly 16% over the previous week. Even though this year’s week 26 included a holiday that occurred in week 27 in recent years, dry van loads were still a bit higher than prior-year comparisons. Loads were about 6% higher than last year and almost 8% above the five-year average. The dry van MDI was lower than the prior week’s record level, but it still was the second-highest MDI ever.

Dry van spot volume was down nearly 16% over the previous week. Even though this year’s week 26 included a holiday that occurred in week 27 in recent years, dry van loads were still a bit higher than prior-year comparisons. Loads were about 6% higher than last year and almost 8% above the five-year average. The dry van MDI was lower than the prior week’s record level, but it still was the second-highest MDI ever.

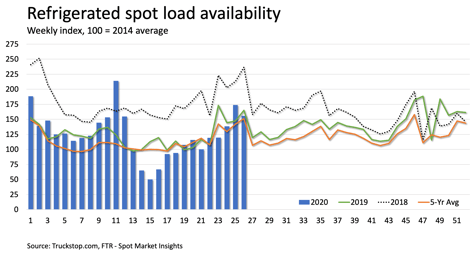

Refrigerated spot loads declined about 10% week over week. Although volume was more than 5% below 2019, it was 3% above the five-year average for the week despite the unfavorable holiday-related distortion. The refrigerated MDI eased from week 25 but remained at the fourth-highest level of the year.

Refrigerated spot loads declined about 10% week over week. Although volume was more than 5% below 2019, it was 3% above the five-year average for the week despite the unfavorable holiday-related distortion. The refrigerated MDI eased from week 25 but remained at the fourth-highest level of the year.

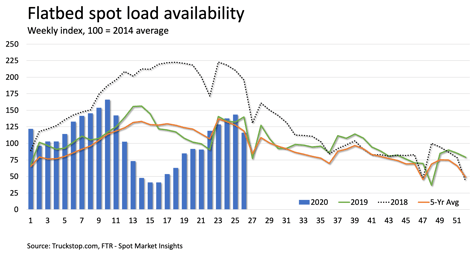

Flatbed spot loads fell about 19%. Volume was about 17% below last year but only about 2% below the five-year average for the week. Truck availability was at its lowest level since the beginning of 2019, so the flatbed MDI eased only slightly from the week 25 level despite the sharp decline in loads.

Flatbed spot loads fell about 19%. Volume was about 17% below last year but only about 2% below the five-year average for the week. Truck availability was at its lowest level since the beginning of 2019, so the flatbed MDI eased only slightly from the week 25 level despite the sharp decline in loads.

While the federal holiday depressed load volumes, it did not stop the recovery in rates. Indeed, the holiday might have even contributed to rate increases given decreased truck capacity in all segments. The total broker-posted rate per mile excluding fuel surcharges increased more than 7 cents during week 26 and was 3.4% higher than the same week last year. Rates remain about 4% below the five-year average, but that’s a sharp recovery from the bottom in mid-April when rates were almost 27% below the five-year average.

While the federal holiday depressed load volumes, it did not stop the recovery in rates. Indeed, the holiday might have even contributed to rate increases given decreased truck capacity in all segments. The total broker-posted rate per mile excluding fuel surcharges increased more than 7 cents during week 26 and was 3.4% higher than the same week last year. Rates remain about 4% below the five-year average, but that’s a sharp recovery from the bottom in mid-April when rates were almost 27% below the five-year average.

Dry van rates rose more than 15 cents a mile, which is the strongest single-week gain of the year, surpassing the strongest week of the March restocking period by a penny. Refrigerated rates rose almost 17 cents, which was the biggest gain in nine weeks. Flatbed rates were up more than 2 cents, which is the smallest increase since week 17.