July Commentaries

|

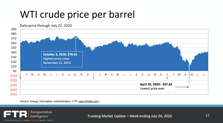

Oil prices have firmed. But for how long? |

|

|

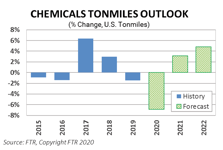

Chemicals Markets Assessment Chemicals are derived of basic chemicals (organic and inorganic), fertilizers, plastics, coatings, cleaners, and pharmaceuticals. Because of the high degree of internal movements, the analysis of transportation is very complicated. |

|

Key Issues in Transportation Q&A Following our annual Key Issues in Transportation webinar, the FTR Experts took additional time to go through all of the Q&A we received. Read the responses to these questions in this article. Topics covered in the Q&A:

|

Complete the form to the right to download these commentaries.

Conditions Indices & Equipment Orders |

FTR’s May Trucking Conditions Index Bounces Back Sharply from April Low But Still Negative

|

FTR’s Shippers Conditions Index for May Falls Sharply M/M but Remains Historically High

|

FTR Reports Final Trailer Orders Rose Significantly in June to 14,400 units |

|

FTR reports final net U.S. trailer orders for June rose significantly to 14,400 units. This was 10,000 units above May and up 9,000 units y/y. Trailer orders rebounded after two sluggish months, with June being the second-highest monthly total this year. Trailer orders for the past twelve months total 164,000.

The June increase was boosted by a recovery in the dry van market, supplemented by decent refrigerated van orders. Flatbed orders remain lethargic. Even though June activity was much improved, there is still too much uncertainty about the pandemic for fleets to have the confidence to order in large quantities. Backlogs continue to fall but are sufficient to support current production in the van segments, while flatbed producers continue to scramble for orders to build in Q4.

|

FTR Reports Preliminary North American Class 8 Net Orders for June Rebound to 15,500 Units

|

|

FTR reports preliminary North American Class 8 net orders rebounded in June to 15,500 units, up 130% from May, as well as, up y/y by 20%. Class 8 net orders for the last twelve months now total 158,000 units.

Fleets’ confidence is improving gradually, as the economy and freight markets recover from the pandemic-related restrictions. The June order volume may not be sustainable in July, however, because some of the larger fleet orders may be difficult to replicate in the short term. Order volume should exceed the 10,000-unit mark throughout the summer as freight volumes continue to improve. |

Latest Industry News with Intelligence from FTR |