Dry van spot rate strength continues in the holiday week

Although total broker-posted spot rates in the Truckstop system eased slightly during Thanksgiving week, dry van rates rose sharply in line with seasonal expectations during the week ended November 25 (week 47). Refrigerated and flatbed spot rates declined after the previous week’s notable gains. Total market rates were in line with the same week two years ago and were modestly above the five-year average. As usual, the holiday week saw a large falloff in load activity in all segments and regions.

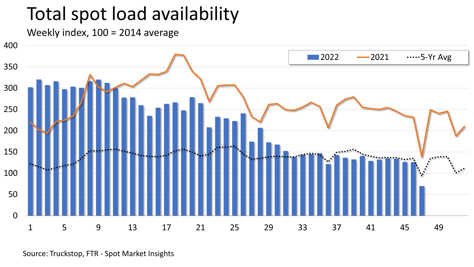

Spot load activity plunged 44.5%. Volume was more than 49% below the same 2021 week and 25% below the five-year average. The deficit relative to the five-year average for the week was the largest since May 2020. Not surprisingly for a major holiday week, volume declines were basically uniform across all regions. Truck availability fell 25.5%, and the Market Demand Index – the ratio of loads to trucks – fell sharply to its lowest level since May 2020. While much lower than the typical loads-to-trucks ratio since the pandemic lockdowns, the MDI in the latest week was slightly above the average weekly MDI during 2019.

Spot load activity plunged 44.5%. Volume was more than 49% below the same 2021 week and 25% below the five-year average. The deficit relative to the five-year average for the week was the largest since May 2020. Not surprisingly for a major holiday week, volume declines were basically uniform across all regions. Truck availability fell 25.5%, and the Market Demand Index – the ratio of loads to trucks – fell sharply to its lowest level since May 2020. While much lower than the typical loads-to-trucks ratio since the pandemic lockdowns, the MDI in the latest week was slightly above the average weekly MDI during 2019.

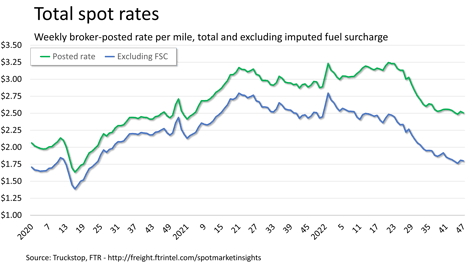

The total broker-posted rate declined more than 2 cents. Rates were nearly 16% below the same 2021 week but almost 6% above the five-year average for the week. However, FTR estimates that rates excluding a calculated fuel surcharge were more than 28% below the same week last year.

The total broker-posted rate declined more than 2 cents. Rates were nearly 16% below the same 2021 week but almost 6% above the five-year average for the week. However, FTR estimates that rates excluding a calculated fuel surcharge were more than 28% below the same week last year.

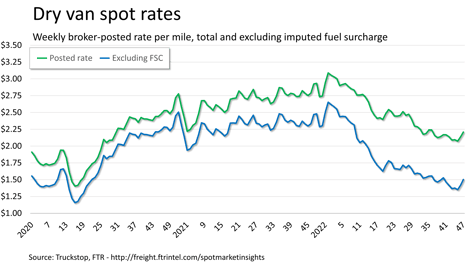

Dry van spot rates rose more than 7 cents after a gain of more than 6 cents in the prior week. Rates were more than 24% below the same 2021 week and almost 5% below the five-year average for the week. Dry van rates excluding a fuel surcharge were more than 39% lower than in the same week last year. Dry van loads fell 41%. Volume was more than 50% below the same 2021 week and more than 28% below the five-year average for the week.

Dry van spot rates rose more than 7 cents after a gain of more than 6 cents in the prior week. Rates were more than 24% below the same 2021 week and almost 5% below the five-year average for the week. Dry van rates excluding a fuel surcharge were more than 39% lower than in the same week last year. Dry van loads fell 41%. Volume was more than 50% below the same 2021 week and more than 28% below the five-year average for the week.

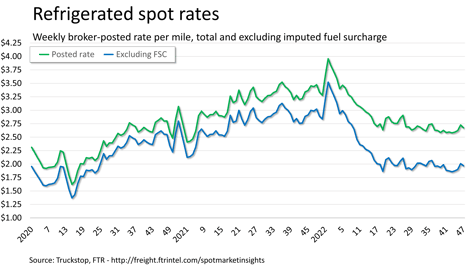

Refrigerated spot rates declined more than 5 cents after rising more than 10 cents in the previous week. Rates were more than 22% below the same 2021 week but right in line with the five-year average for the week. Rates excluding fuel surcharges were about 34% below the same week last year. Refrigerated loads fell 42.8% after four straight weeks of increases. Volume was 51% below the same week last year and more than 22% below the five-year average.

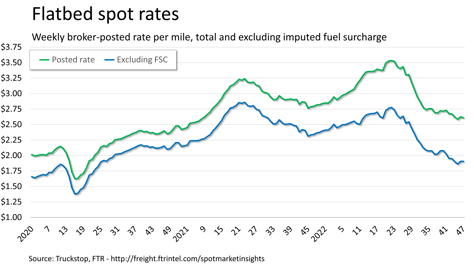

Flatbed spot rates declined 1.4 cents after rising just under 4 cents in the prior week. Rates were nearly 7% below the same 2021 week but more than 16% above the five-year average for the week. However, excluding an imputed surcharge, flatbed rates were almost 19% below the same week last year. Flatbed loads plunged 51.6% after easing just over 1% in the previous week. Volume was 57% below the same 2021 week and about 31% below the five-year average for the week.