Spot rates finally see strength the week before Thanksgiving

The spot market finally showed its typical pre-Thanksgiving boost in rates, but it took until the week before the holiday for it to happen. Broker-posted rates in the Truckstop system rose in the three principal segments – dry van, refrigerated, and flatbed – during the week ended November 18 (week 46). For dry van and flatbed, the gains were the largest since the International Roadcheck inspection event in May. The rate increase in refrigerated was the largest since the week before Labor Day.

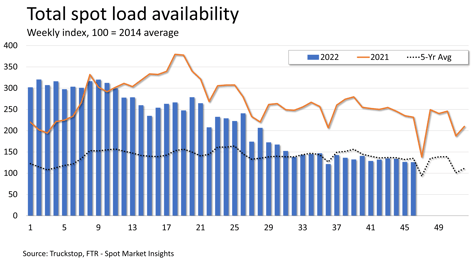

Although the week was strong for rates, the same cannot be said for volume. Spot load activity eased 0.4% after the prior week’s 5.6% drop. Volume was almost 46% below the same 2021 week and nearly 7% below the five-year average. Load activity was mixed with the Midwest recording the strongest gain and the West Coast seeing the largest decrease. Truck availability declined 0.8%. The Market Demand Index – the ratio of loads to trucks – edged slightly higher.

Although the week was strong for rates, the same cannot be said for volume. Spot load activity eased 0.4% after the prior week’s 5.6% drop. Volume was almost 46% below the same 2021 week and nearly 7% below the five-year average. Load activity was mixed with the Midwest recording the strongest gain and the West Coast seeing the largest decrease. Truck availability declined 0.8%. The Market Demand Index – the ratio of loads to trucks – edged slightly higher.

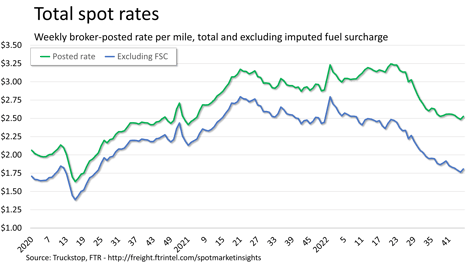

The total broker-posted rate increased just over 4 cents for the first gain in five weeks. The gain was the largest since the week following the International Roadcheck event. Rates were about 13% below the same 2021 week but nearly 9% above the five-year average for the week. However, FTR estimates that rates excluding a calculated fuel surcharge were more than 26% below the same week last year.

The total broker-posted rate increased just over 4 cents for the first gain in five weeks. The gain was the largest since the week following the International Roadcheck event. Rates were about 13% below the same 2021 week but nearly 9% above the five-year average for the week. However, FTR estimates that rates excluding a calculated fuel surcharge were more than 26% below the same week last year.

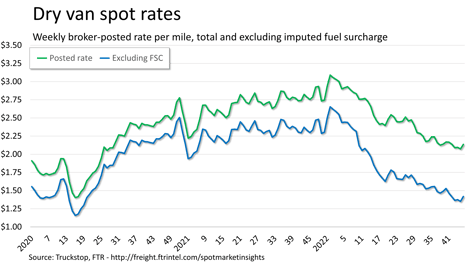

Dry van spot rates rose more than 6 cents for only the second increase in six weeks. Rates were more than 23% below the same 2021 week and about 4% below the five-year average for the week. FTR estimates that dry van rates excluding a fuel surcharge were more than 39% lower than in the same week last year. Dry van loads ticked up 1.6%. Volume was nearly 45% below the same 2021 week and more than 8% below the five-year average for the week.

Dry van spot rates rose more than 6 cents for only the second increase in six weeks. Rates were more than 23% below the same 2021 week and about 4% below the five-year average for the week. FTR estimates that dry van rates excluding a fuel surcharge were more than 39% lower than in the same week last year. Dry van loads ticked up 1.6%. Volume was nearly 45% below the same 2021 week and more than 8% below the five-year average for the week.

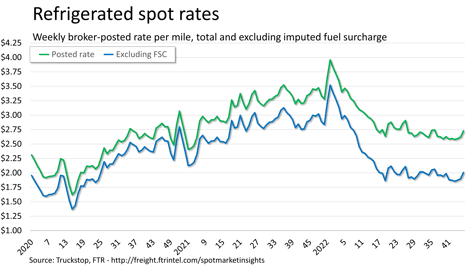

Refrigerated spot rates jumped 10.5 cents. Rates were 21% below the same 2021 week but about 4% above the five-year average for the week. Rates excluding fuel surcharges were 33% below the same week last year. Refrigerated loads increased 2% after rising 13% in the previous week. Volume was about 45% below the same week last year and nearly 5% below the five-year average.

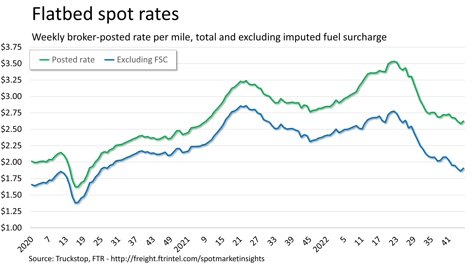

Flatbed spot rates increased just under 4 cents for the first week-over-week gain in five weeks. Rates were nearly 6% below the same 2021 week but nearly 17% above the five-year average for the week. However, excluding an imputed surcharge, flatbed rates were about 18% below the same week last year. Flatbed loads declined 1.3% after the sharp 14.9% drop in the prior week. Volume was about 54% below the same 2021 week and about 18% below the five-year average for the week.