Spot volume eases, rates are steady in the latest week

The spot market changed little during the week ended September 30 (week 39) as total rates edged up slightly and volume declined modestly. Hurricane Ian did not make landfall in Florida until Wednesday afternoon, so it might have had only a minor impact on the weekly figures. However, both dry van and refrigerated saw notable load posting gains in the Southeast even as volume was down or rose only marginally in all other regions. Dry van rates ticked up slightly, but refrigerated rates fell.

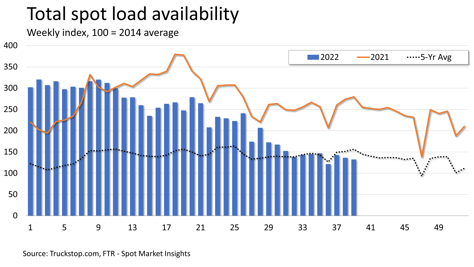

Total load postings declined 2.9% after falling 4.5% in the previous week. Volume was nearly 53% below the same 2021 week and about 15% below the five-year average for the week. Dry van volume increased about 15% in the Southeast even though it was down in all other regions except the Midwest, where it ticked up about 1%. Similarly, refrigerated volume rose 16.5% in the Southeast but was down in all other regions. Truck postings increased 2.7%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since June 2020.

Total load postings declined 2.9% after falling 4.5% in the previous week. Volume was nearly 53% below the same 2021 week and about 15% below the five-year average for the week. Dry van volume increased about 15% in the Southeast even though it was down in all other regions except the Midwest, where it ticked up about 1%. Similarly, refrigerated volume rose 16.5% in the Southeast but was down in all other regions. Truck postings increased 2.7%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since June 2020.

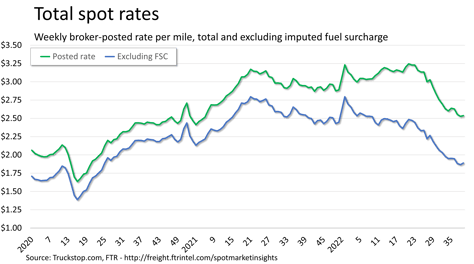

The total broker-posted rate in the system increased nearly 1 cent. Rates were about 14% below the same 2021 week but about 8% above the five-year average. However, FTR estimates that excluding an imputed fuel surcharge, rates were nearly 26% below the same week last year.

The total broker-posted rate in the system increased nearly 1 cent. Rates were about 14% below the same 2021 week but about 8% above the five-year average. However, FTR estimates that excluding an imputed fuel surcharge, rates were nearly 26% below the same week last year.

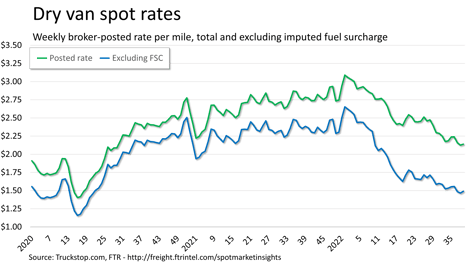

Dry van spot rates edged up a little more than 1 cent. Rates were about 23% lower than the same 2021 week and more than 1% below the five-year average for the week. Rates were nearly 38% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings were essentially unchanged after edging up 1% during the previous week. Volume was about 49% below the level posted in the same 2021 week and more than 7% below the five-year average for the week.

Dry van spot rates edged up a little more than 1 cent. Rates were about 23% lower than the same 2021 week and more than 1% below the five-year average for the week. Rates were nearly 38% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings were essentially unchanged after edging up 1% during the previous week. Volume was about 49% below the level posted in the same 2021 week and more than 7% below the five-year average for the week.

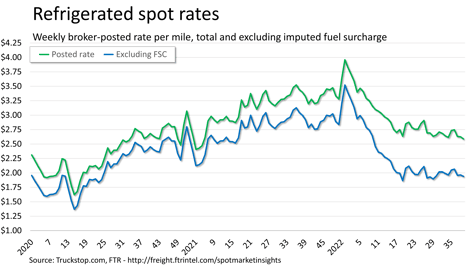

Refrigerated spot rates decreased nearly 4 cents. Rates were about 22% below the same 2021 week but nearly 3% above the five-year average for the week. Rates excluding fuel surcharges were nearly 34% below the same week last year. Refrigerated load postings fell 9.1% after decreasing 6.5% in the prior week. Volume was nearly 52% below the same 2021 week and about 2% below the five-year average for the week for only the second time since June 2020 that weekly refrigerated volume was below the five-year average.

Refrigerated spot rates decreased nearly 4 cents. Rates were about 22% below the same 2021 week but nearly 3% above the five-year average for the week. Rates excluding fuel surcharges were nearly 34% below the same week last year. Refrigerated load postings fell 9.1% after decreasing 6.5% in the prior week. Volume was nearly 52% below the same 2021 week and about 2% below the five-year average for the week for only the second time since June 2020 that weekly refrigerated volume was below the five-year average.

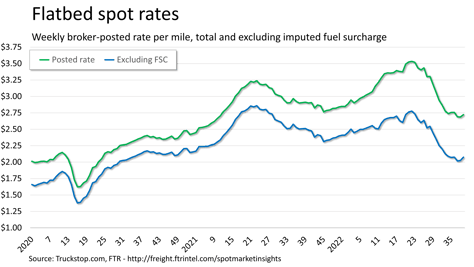

Flatbed spot rates increased nearly 4 cents for the largest gain since May. Rates were nearly 7% below the same 2021 week but still about 16% above the five-year average for the week. However, excluding an imputed surcharge, flatbed rates were about 17% below the same week last year. Flatbed load postings eased 1.4% after falling 10.7% in the previous week. Volume was nearly 61% below the same 2021 week and about 32% below the five-year average for the week.

Flatbed spot rates increased nearly 4 cents for the largest gain since May. Rates were nearly 7% below the same 2021 week but still about 16% above the five-year average for the week. However, excluding an imputed surcharge, flatbed rates were about 17% below the same week last year. Flatbed load postings eased 1.4% after falling 10.7% in the previous week. Volume was nearly 61% below the same 2021 week and about 32% below the five-year average for the week.