Spot rates, volume declined modestly in the latest week

Following the typical swings related to the Labor Day holiday, the spot market largely reverted to seasonal softness during the week ended September 23 (week 38). Total broker-posted rates in the Truckstop.com system eased but were essentially unchanged in refrigerated and flatbed. Rates in dry van and refrigerated continued to track with the five-year average while flatbed rates are stable at above-average levels. Spot volume declined for the first time in six weeks except for the holiday week.

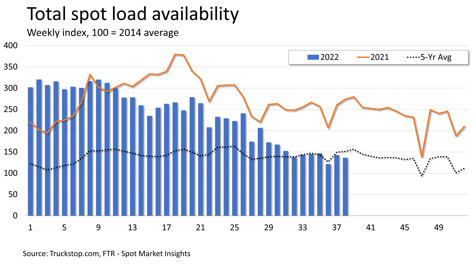

Total load postings decreased 4.5% after a post-holiday rebound of 17.4% in the previous week. Volume was about 50% below the same 2021 week and nearly 10% below the five-year average for the week due almost exclusively to weakness in flatbed. Load postings were down in all regions, but van segment postings were up in the Southeast. Truck postings ticked up 0.3%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – declined to its lowest level in six weeks.

Total load postings decreased 4.5% after a post-holiday rebound of 17.4% in the previous week. Volume was about 50% below the same 2021 week and nearly 10% below the five-year average for the week due almost exclusively to weakness in flatbed. Load postings were down in all regions, but van segment postings were up in the Southeast. Truck postings ticked up 0.3%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – declined to its lowest level in six weeks.

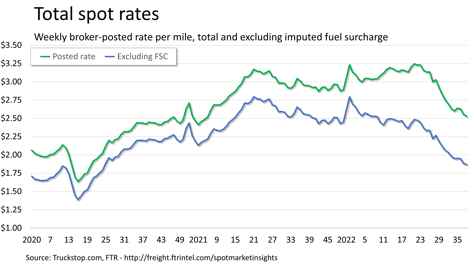

The total broker-posted rate in the system declined nearly 3 cents. Rates were about 14% below the same 2021 week but about 8% above the five-year average. However, FTR estimates that excluding an imputed fuel surcharge, rates were nearly 27% below the same week last year.

The total broker-posted rate in the system declined nearly 3 cents. Rates were about 14% below the same 2021 week but about 8% above the five-year average. However, FTR estimates that excluding an imputed fuel surcharge, rates were nearly 27% below the same week last year.

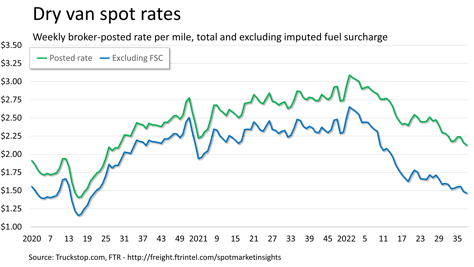

Dry van spot rates decreased about 3 cents. Rates were nearly 23% lower than the same 2021 week and nearly 1% below the five-year average for the week. Rates were nearly 35% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings edged up 1% after jumping nearly 22% in the previous week. Volume was about 46% below the level posted in the same 2021 week and 0.6% below the five-year average for the week.

Dry van spot rates decreased about 3 cents. Rates were nearly 23% lower than the same 2021 week and nearly 1% below the five-year average for the week. Rates were nearly 35% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings edged up 1% after jumping nearly 22% in the previous week. Volume was about 46% below the level posted in the same 2021 week and 0.6% below the five-year average for the week.

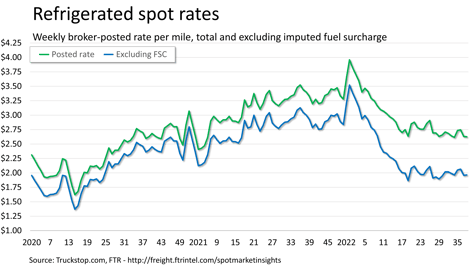

Refrigerated spot rates eased just a half-cent from the prior week. Rates were nearly 23% below the same 2021 week but nearly 4% above the five-year average for the week. Rates excluding fuel surcharges were nearly 36% below the same week last year. Refrigerated load postings decreased 6.5% after rebounding more than 13% in the prior week. Volume was nearly 47% below the same 2021 week but about 10% above the five-year average for the week.

Refrigerated spot rates eased just a half-cent from the prior week. Rates were nearly 23% below the same 2021 week but nearly 4% above the five-year average for the week. Rates excluding fuel surcharges were nearly 36% below the same week last year. Refrigerated load postings decreased 6.5% after rebounding more than 13% in the prior week. Volume was nearly 47% below the same 2021 week but about 10% above the five-year average for the week.

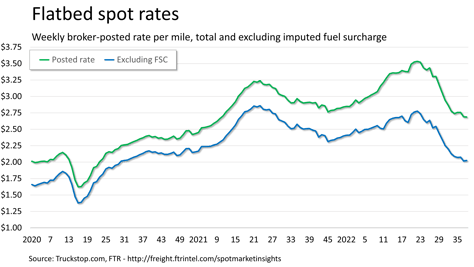

Flatbed spot rates declined by nearly a half-cent. Rates were nearly 8% below the same 2021 week but still about 15% above the five-year average for the week. However, excluding an imputed surcharge, flatbed rates were about 19% below the same week last year. Flatbed load postings fell 10.7% after rebounding 17.1% in the previous week. Volume was nearly 61% below the same 2021 week and more than 30% below the five-year average for the week. The segment’s deficit relative to the five-year average was the largest since April 2020.

Flatbed spot rates declined by nearly a half-cent. Rates were nearly 8% below the same 2021 week but still about 15% above the five-year average for the week. However, excluding an imputed surcharge, flatbed rates were about 19% below the same week last year. Flatbed load postings fell 10.7% after rebounding 17.1% in the previous week. Volume was nearly 61% below the same 2021 week and more than 30% below the five-year average for the week. The segment’s deficit relative to the five-year average was the largest since April 2020.