Flatbed weakness continues in rates and volume

Flatbed spot rates in the Truckstop.com system continued to fall sharply during the week ended August 5 (week 31) as the segment recorded its first negative year-over-year comparison since July 2020. Rates in other key segments were more resilient as dry van rates dipped only slightly and refrigerated rates saw their largest increase since late June. Load postings were down in all segments, led by flatbed, which saw volume fall below the five-year average for the first time since June 2020.

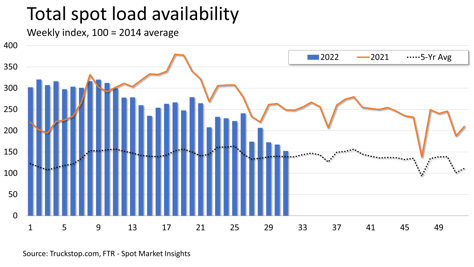

Total load postings decreased 9.0%. Volume was about 39% below the same 2021 week but still nearly 10% above the five-year average for the week. Volume was down in all regions except for Mountain Central, which is the smallest of all regions in volume. Truck postings declined 6.0%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since June 2020.

Total load postings decreased 9.0%. Volume was about 39% below the same 2021 week but still nearly 10% above the five-year average for the week. Volume was down in all regions except for Mountain Central, which is the smallest of all regions in volume. Truck postings declined 6.0%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – fell to its lowest level since June 2020.

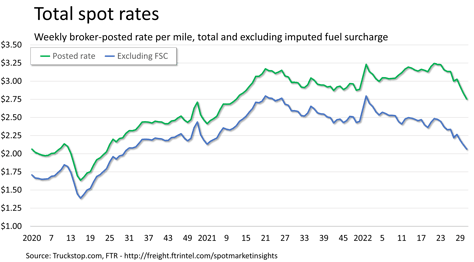

The total broker-posted rate in the system fell about 8 cents. Rates in the system were 7.5% below the same 2021 week but nearly 17% above the five-year average for the week. However, FTR estimates that excluding an imputed fuel surcharge, rates would be down about 20% year over year.

The total broker-posted rate in the system fell about 8 cents. Rates in the system were 7.5% below the same 2021 week but nearly 17% above the five-year average for the week. However, FTR estimates that excluding an imputed fuel surcharge, rates would be down about 20% year over year.

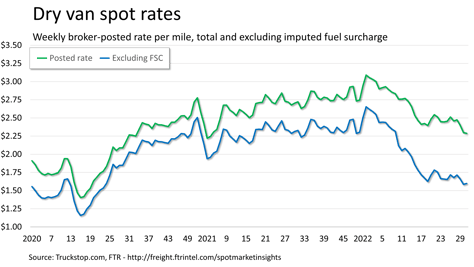

Dry van spot rates dipped by a cent. Rates were 16% lower than the same 2021 week but nearly 7% higher than the five-year average for the week. However, dry van rates were more than 31% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings decreased 5.4%. Volume was about 36% below the level posted in the same 2021 week but about 14% above the five-year average for the week.

Dry van spot rates dipped by a cent. Rates were 16% lower than the same 2021 week but nearly 7% higher than the five-year average for the week. However, dry van rates were more than 31% lower than the same 2021 week if an imputed fuel surcharge is excluded. Dry van load postings decreased 5.4%. Volume was about 36% below the level posted in the same 2021 week but about 14% above the five-year average for the week.

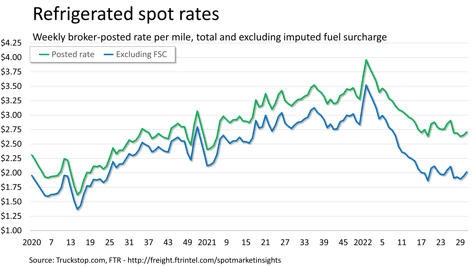

Refrigerated spot rates increased more than 5 cents, which is the largest gain since one of the same magnitude in week 26. Rates were about 17% below the same 2021 week but about 8% above the five-year average for the week. However, rates excluding fuel surcharges were nearly 30% below the same week last year. Refrigerated load postings declined 3.8%. Volume was about 43% below the same week last year but nearly 14% above the five-year average for the week.

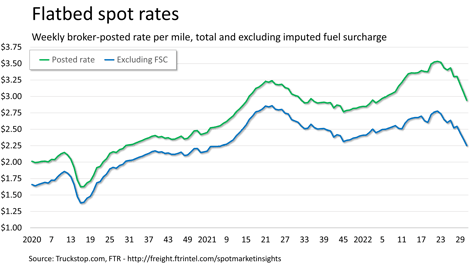

Flatbed spot rates fell nearly 12 cents after a drop of essentially the same amount during the previous week. The broker-posted rate has plunged more than 49 cents (14.3%) over the past five weeks. Flatbed rates were 2.0% below the same 2021 week, but they were still about 24% above the five-year average for the week. However, excluding an imputed surcharge, flatbed rates were nearly 14% below the same week last year. Flatbed load postings fell 13.5%. Volume was about 45% below the same 2021 week and 1.5% below the five-year average for the week.

Flatbed spot rates fell nearly 12 cents after a drop of essentially the same amount during the previous week. The broker-posted rate has plunged more than 49 cents (14.3%) over the past five weeks. Flatbed rates were 2.0% below the same 2021 week, but they were still about 24% above the five-year average for the week. However, excluding an imputed surcharge, flatbed rates were nearly 14% below the same week last year. Flatbed load postings fell 13.5%. Volume was about 45% below the same 2021 week and 1.5% below the five-year average for the week.