Flatbed powers the spot market in the latest week

Sharply stronger flatbed load postings and rates were principally responsible for an increase in spot volume and only a small decline in rates during the week ended January 14 (week 2). Total volume rose 6.1% while total spot rates declined nearly 4 cents. Dry van volume was barely above flat week over week, but dry van and refrigerated metrics otherwise were weaker than in the prior week. Widespread winter weather over the weekend could result in bigger changes in spot metrics in the coming week.

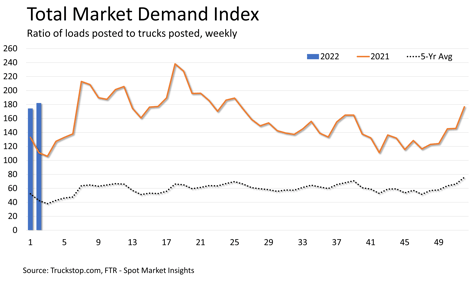

Truck postings edged up 1.6% after the 45.7% jump in the prior week coming out of the holidays. With the gain in load postings exceeding the rise in truck postings, the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – increased to the highest level since late June. The flatbed MDI rose to its highest level since early June 2021, but the MDIs for dry van and refrigerated moved lower.

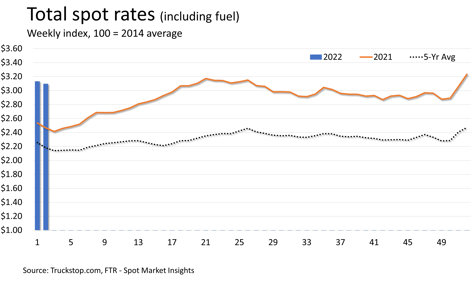

Total spot rates were nearly 26% higher than the same 2021 week. Rates excluding fuel were about 20% higher year over year. Dry van rates declined more than 2 cents and were about 25% higher than the same 2021 week. Refrigerated rates fell about 11 cents and were about 41% higher than in the same 2021 week. Flatbed rates rose 6 cents – the strongest gain since the week before Labor Day – and were 21% higher year over year.

Total spot rates were nearly 26% higher than the same 2021 week. Rates excluding fuel were about 20% higher year over year. Dry van rates declined more than 2 cents and were about 25% higher than the same 2021 week. Refrigerated rates fell about 11 cents and were about 41% higher than in the same 2021 week. Flatbed rates rose 6 cents – the strongest gain since the week before Labor Day – and were 21% higher year over year.

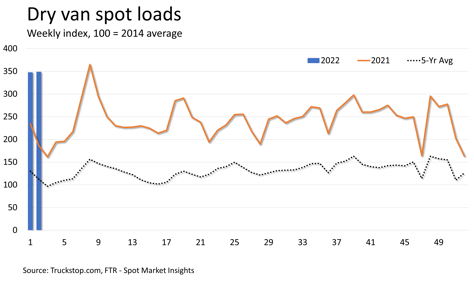

Dry van load postings ticked up 0.3% after the 45.6% jump following the holidays. Dry van volume was the strongest on record aside for one week in mid-February 2021. Load postings were about 87% higher than the same 2021 week and more than triple the five-year average for the week.

Dry van load postings ticked up 0.3% after the 45.6% jump following the holidays. Dry van volume was the strongest on record aside for one week in mid-February 2021. Load postings were about 87% higher than the same 2021 week and more than triple the five-year average for the week.

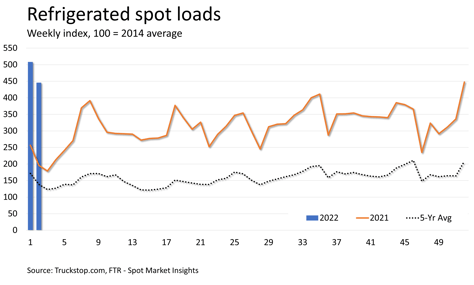

Refrigerated volume fell 12.3% from the prior week’s record level. Refrigerated volume was nearly 128% higher than the same 2021 week and about 223% higher than the five-year average.

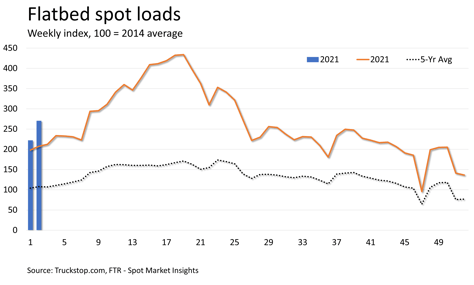

Flatbed load postings jumped 21.8% after surging nearly 63% following the holidays. Flatbed volume was the strongest since late June 2021. Load postings were nearly 31% higher than the same week last year and about 151% above the five-year average.

Flatbed load postings jumped 21.8% after surging nearly 63% following the holidays. Flatbed volume was the strongest since late June 2021. Load postings were nearly 31% higher than the same week last year and about 151% above the five-year average.