Spot volume sees typical post-holiday rebound

Total spot load postings in the Truckstop.com system jumped 43.7% during the week ended January 7 (week 1), following the typical pattern of a rebound after a holiday lull. Loads were up in all segments, including a modest gain in refrigerated to surpass the record posted during the prior week. Dry van volume was the second highest on record after a weather-related spike last February. Rates fell 10 cents from the prior week’s record, but flatbed rates saw their strongest gain in 10 weeks.

Spot volume invariably rises sharply during the first week of the year compared to the final week of the previous year. Disruptions due to winter weather in much of the U.S. also likely contributed to the strength in load postings, although supply chain disruptions had already maintained a high floor on volume. Weather-related disruptions also might have muted declines in rates that typically occur during the first week of the year.

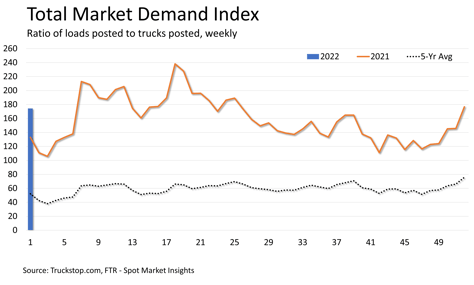

Truck postings jumped 45.7% to their highest level since June. With the gain in truck postings slightly exceeding the rise in load postings, the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – also eased slightly. The MDIs for dry van and flatbed moved higher, but the refrigerated MDI eased slightly from its record level at the end of December.

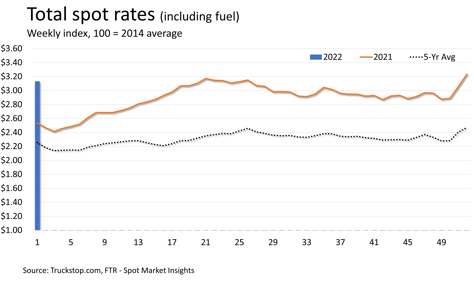

Total spot rates were nearly 24% higher than the same 2021 week. Rates excluding fuel were about 18% higher year over year. Dry van and refrigerated rates declined from the records set during the final week of 2021. Dry van rates eased nearly 4 cents and were about 18% higher than the same 2021 week. Refrigerated rates fell nearly 14 cents after surging 68 cents during the final two weeks of 2021. Refrigerated rates were about 34% higher than in the same 2021 week. Flatbed rates rose nearly 4 cents and were about 19% higher year over year.

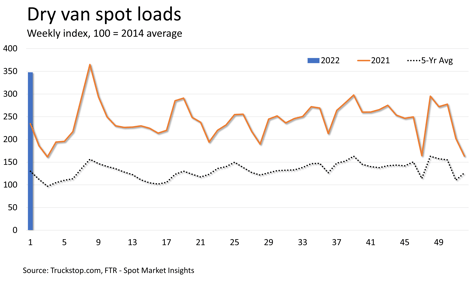

Dry van load postings jumped 45.6% after rising about 18% during the final week of 2021. Dry van volume was the strongest on record except for a week in mid-February 2021 that was attributed mostly to extreme winter weather. Load postings were about 48% higher than the same 2021 week and nearly 168% higher than the five-year average for the week.

Dry van load postings jumped 45.6% after rising about 18% during the final week of 2021. Dry van volume was the strongest on record except for a week in mid-February 2021 that was attributed mostly to extreme winter weather. Load postings were about 48% higher than the same 2021 week and nearly 168% higher than the five-year average for the week.

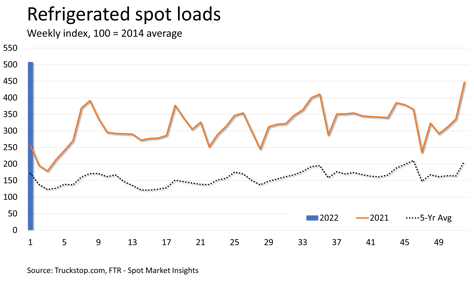

Refrigerated volume increased 13.6% to a record level, surpassing the record set just a week earlier. Winter weather likely added to the market stress already in place due to ongoing grocery store shortages in various food products. Refrigerated volume was nearly double the volume during the same 2021 week and nearly triple the five-year average.

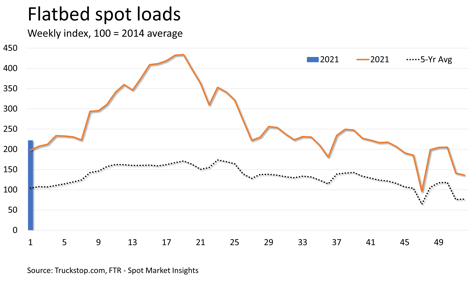

Flatbed load postings surged 62.9% after falling by nearly a third during December. Flatbed volume was the strongest since mid-October. Load postings were about 12% higher than the same week last year and about 113% above the five-year average. Flatbed spot volume likely will begin running negative year over year in February if not before.

Flatbed load postings surged 62.9% after falling by nearly a third during December. Flatbed volume was the strongest since mid-October. Load postings were about 12% higher than the same week last year and about 113% above the five-year average. Flatbed spot volume likely will begin running negative year over year in February if not before.