Spot volume rises to its strongest level since June

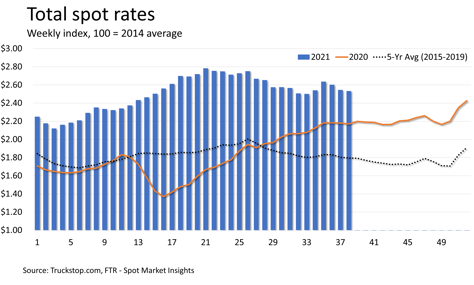

Total load postings in the Truckstop.com system added to the rebound from Labor Day’s lost productivity, rising 5.3% during the week ended September 24 (week 38) to the highest level since the end of June. Dry van and flatbed each posted volume gains of more than 6%, but spot volume was flat week over week in the refrigerated segment. Overall, spot volume is outpacing seasonal expectations as major disruptions continue in the supply chain. Spot rates eased slightly in the latest week.

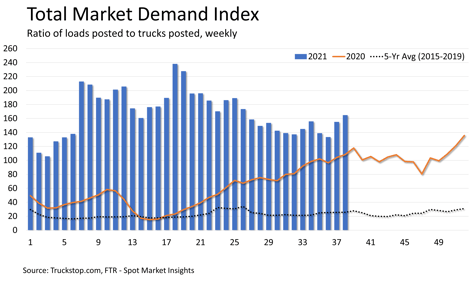

Volume in the latest week was about 32% above the same 2020 week and about 162% above the five-year average (2015-2019). While load postings were up modestly from the prior week, truck postings declined nearly 1%. The Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – rose to its highest level since the end of June. The MDI was higher week over week in all segments.

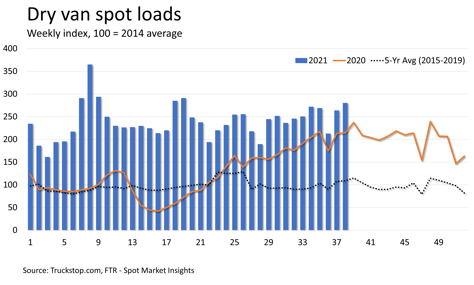

Dry van load postings increased 6.3% after the prior week’s 23.9% rebound from the holiday. Volume was at its highest level since mid-May when the market was still working through issues associated with the International Roadcheck inspection event. Load postings were about 31% above the same 2020 week and about 157% above the five-year average for the week.

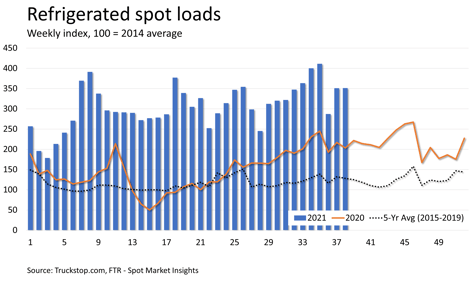

Refrigerated load volume was basically unchanged in the latest week after rising 22.3% during the prior week. Load postings remained nearly 15% below week 35’s record level. Refrigerated volume was about 73% higher than the same week last year and about 174% above the five-year average.

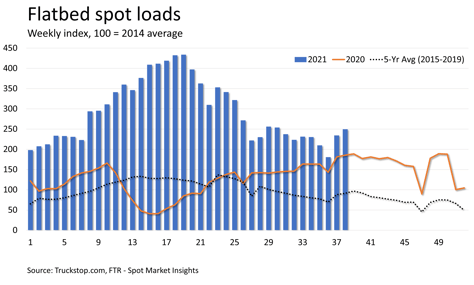

Flatbed load postings rose 6.5% after jumping nearly 30% during the week following the holiday week. Volume was at its strongest level since early August. Flatbed volume was about 35% higher than the same week last year and about 173% higher than the five-year average.

The broker-posted rate per mile excluding fuel surcharges declined by about 1 cent for the third straight decrease. Rates were about 17% higher than the same 2020 week, which was the same comparison recorded in the prior week. Dry van rates were down about 3 cents and were about 11% higher than rates in the same week last year. Refrigerated rates fell nearly 5 cents and were about 27% higher than the same 2020 week. Flatbed rates were basically unchanged and were about 16% higher than the same week last year.