Spot market volume falls from record level

Following a sharp rebound that had resulted in a weekly record, load volume in the Truckstop.com system fell 8.1% during the week ended January 15, 2021 (week 2). Dry van and refrigerated load postings fell sharply, but flatbed volume was up modestly after the previous week’s sharp gain. While volume fell, truck postings increased, leading to a decline in the ratio of loads to its lowest level in five weeks. Spot rates excluding fuel fell nearly 8 cents to their lowest level in six weeks.

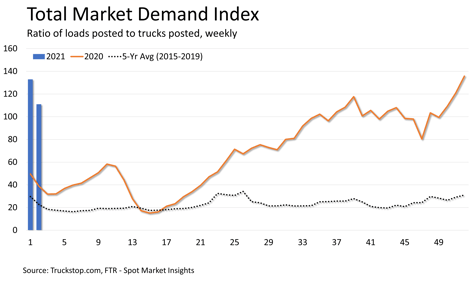

Total load volume was up more than 65% year over year and 152% higher than the five-year average for the week. Truck postings increased 10.1% week over week. Although the gain was far smaller than the 54.7% increase the previous week, capacity was up by double-digit percentages in consecutive weeks for the first time in two years. The result was a slight easing in the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – to the lowest level since week 50 of 2020.

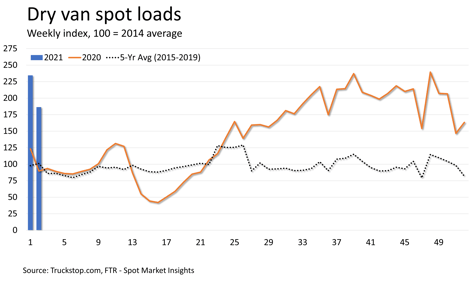

Dry van load volume fell nearly 21% week over week. Dry van loads were 90% higher than the same 2020 week and nearly 140% higher than the five-year average. Dry van truck postings rose more than 15%, resulting in the lowest dry van MDI since August.

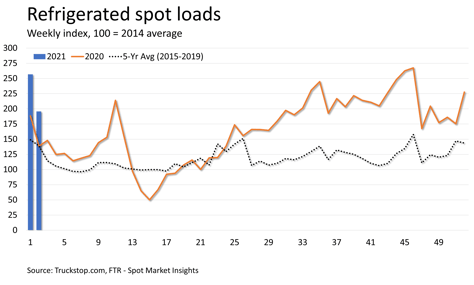

Refrigerated loads dropped nearly 24% to the lowest level in four weeks. Refrigerated volume was up about 41% year over year and more than 72% ahead of the five-year average. Truck postings were up nearly 7%, resulting in the lowest refrigerated MDI in five weeks.

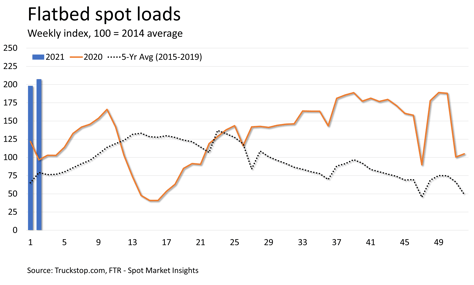

Flatbed loads increased nearly 5% week over week to the strongest level since June 2018. Flatbed volume was up about 115% from the same 2020 and nearly 162% ahead of the five-year average. Truck postings were up more than 8%, and the flatbed MDI eased slightly from the record set in week 1.

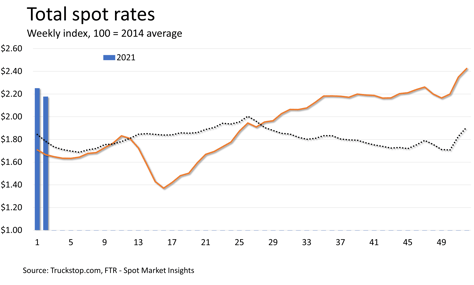

The broker-posted rate per mile excluding fuel surcharges fell more than 7 cents to the lowest level in six weeks. Rates are about 31% above the same 2020 week and about 22% higher than the five-year average. However, flatbed rates were up slightly while dry van and refrigerated rates dropped significantly. Dry van rates, which fell about 17 cents, were up about 42% year over year. Refrigerated rates, which dropped about 21 cents, were about 26% higher than the same 2020 week. Flatbed rates were up about 1 cent and were up 31% year over year.